Exporting vehicles to Puerto Rico combines U.S. domestic compliance with territory-specific logistics and taxes.

Although no customs duty applies, understanding Ro-Ro shipping, local excise and sales taxes, and registration requirements is essential to protect margins. This guide walks you through documentation, cost modeling, and sourcing strategies for profitable exports.

Key Takeaways

- No customs duty for Puerto Rico imports

- Local levies: 10 % excise tax and 11.5 % sales/use tax

- Required docs: U.S. title, bill of lading, EPA emissions and DOT safety certificates

- Ro-Ro shipping from U.S. East Coast ports takes 3–7 days

- Build a landed-cost model including freight, port fees, and local taxes

- Auction sourcing delivers nationwide U.S. inventory and title verification

Understanding the Puerto Rico Market

Puerto Rico depends entirely on imports for its vehicle supply. Demand is driven by dense urban areas, vibrant tourism, and a market preference for late-model and used cars.

Rental fleets turn over frequently, creating a steady need for reliable, compliant vehicles. The market is highly influenced by mainland U.S. trends, making it ideal for exporters familiar with federal compliance standards.

Regulations & Compliance

Puerto Rico adheres to U.S. federal import regulations, making it more straightforward for mainland exporters. Four key documents are required:

| Document | Purpose |

| U.S. Certificate of Title | Establishes clear legal ownership |

| Bill of Lading | Confirms sea transport details |

| EPA Emissions Certificate | Verifies compliance with federal emissions rules |

| DOT Safety Certificate | Confirms adherence to U.S. safety standards |

Exporters must provide all four to clear DTOP registration.

Tariffs, Fees & Taxes

While Puerto Rico is exempt from U.S. customs duties, several local taxes and fees still apply:

| Fee Type | Rate / Amount |

| Excise Tax | 10 % of Fair Market Value |

| Sales & Use Tax | 11.5 % of sale price |

| Port Handling & Wharfage | Varies by terminal |

Crafting Your Landed-Cost Model

Detail every cost element before setting your margin:

| Cost Component | Basis |

| FOB Purchase Price | U.S. dealer/exporter net price |

| Ro-Ro Freight | Contract rate per vehicle |

| Port Handling | Wharfage and terminal handling charges |

| Excise Tax (10 %) | 0.10 × (FOB + Freight + Handling) |

| Sales & Use Tax (11.5 %) | 0.115 × sale price to end buyer |

Add a 10–15 % markup on total landed cost to buffer unexpected expenses.

Logistics & Shipping Routes

Puerto Rico is well-served by frequent, fast shipping routes:

- Jacksonville → San Juan: 3–5 days via Ro-Ro carriers (SEACOR, TOTE)

- Savannah → Ponce: 5–7 days, Ro-Ro and container options (Crowley, Seaboard)

- Miami → San Juan: Frequent short-sea services accommodate both methods

Common Pitfalls to Avoid

Exporting vehicles to Puerto Rico can be highly profitable, but it comes with its own set of regulatory and logistical challenges.

Many exporters, especially those new to the market, overlook critical factors like local taxation, required federal documentation, and elevated shipping or port fees.

Missteps in any of these areas can lead to unexpected costs, delays, or compliance issues that erode margins and frustrate buyers.

By understanding and planning for these common pitfalls in advance, exporters can streamline their operations and maximize returns in the Puerto Rican market.

| Common Pitfall | Details |

|---|---|

| Ignoring Local Taxes | Failing to calculate excise and sales tax in landed cost can result in eroded profit. |

| Skipping EPA/DOT Docs | Missing federal emissions or safety documents will delay DTOP registration. |

| Under-budgeting Port Fees | Terminal handling and wharfage charges can add hundreds to total cost if not pre-estimated. |

| Assuming Domestic Rates | Island freight and handling rates are higher than U.S. domestic routes—plan accordingly. |

Why Auctions Are a Smart Choice for Car Purchases

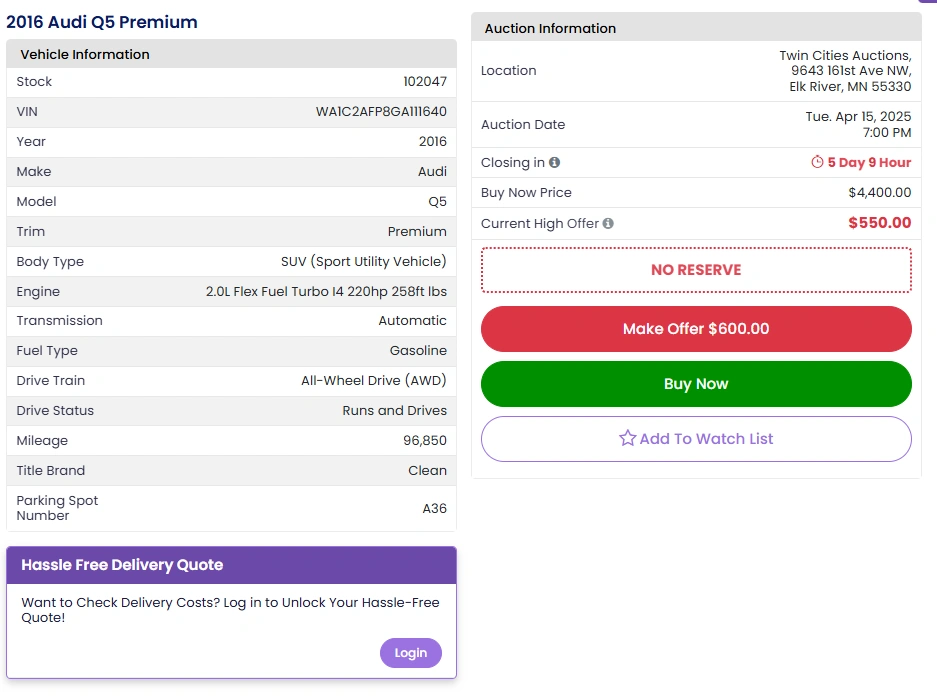

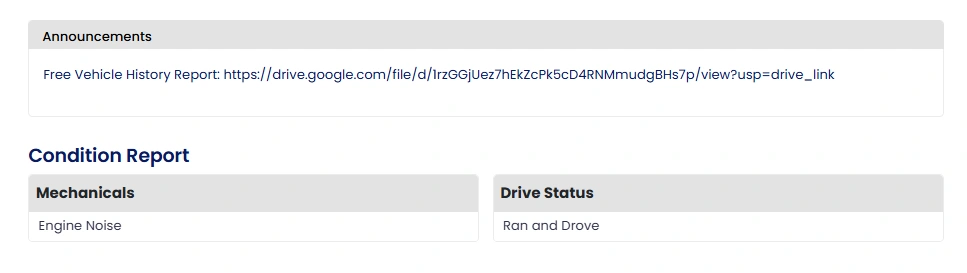

Auctions can be an excellent source for late-model vehicles with clear chains of title and affordable pricing. Twin Cities Auctions, based in Minnesota, is one such reputable auction house that offers a wide range of vehicles at competitive prices.

Key Benefits of Buying from Auctions:

- Wide Selection: Auctions like Twin Cities Auctions offer a variety of vehicles, from low-budget cars to high-end models.

- Competitive Pricing: Auctions often offer vehicles at prices below retail value, enabling dealers to maximize their profit margins.

- Transparency: Auctions provide full vehicle history reports, so you know exactly what you’re buying.

- Convenient Bidding: Many auctions offer online bidding for your convenience, making it easier to source vehicles without being physically present.

Twin Cities Auctions: A Smart Vehicle Sourcing Choice

For those in the automotive industry, Twin Cities Auctions offers an excellent platform for sourcing quality vehicles at competitive prices.

Whether you are just starting or expanding your business, this auction house provides transparency, competitive pricing, and a broad selection.

| Feature | Description |

| Inventory Variety | Wide range of cars, trucks, and SUVs available |

| Competitive Pricing | Below-market pricing allows for higher profit margins |

| Vehicle History Reports | Detailed history reports for every vehicle |

| Online Bidding | Convenient online bidding options for dealers |

| Financing Options | Financing available to help with inventory purchases |

Conclusion

Exporting cars to Puerto Rico offers tariff-free margins but demands precision in cost modeling and compliance. Mastering Ro-Ro logistics, local tax structures, and federal certification requirements, and sourcing through reliable auctions, creates a streamlined path to profitable, repeatable exports.

Twin Cities Auctions: No Dealer License? No Problem!

Are you interested in buying or selling a car but worried about the complexities of needing a dealer license? Worry no more! At Twin Cities Auctions, we’ve removed the barriers, making our auctions open to everyone.

Whether you’re a seasoned buyer or a first-time seller, our platform offers a welcoming environment where you can participate freely. Experience the ease and excitement of our next auction and discover just how simple and rewarding a car auction can be!

Looking for more options? Explore our comprehensive list of all available car auctions across the United States. Your next deal might be just a click away!

FAQ

Are there customs duties for Puerto Rico imports?

No—Puerto Rico is part of the U.S. customs territory, so no customs duties apply.

What local taxes apply?

Excise tax of 10 % of Fair Market Value and sales/use tax of 11.5 %.

How long does transit take?

Ro-Ro shipping from major East Coast ports typically takes 3–7 days.

What shipping methods are best?

Ro-Ro is generally most cost-effective; containers suit specialty or oversized vehicles.

Which compliance certificates are required?

EPA emissions and DOT safety certificates must accompany each vehicle for registration.

Source Links

https://www.portofpr.com/sites/default/files/2023-05/Annual%20Report%20FY2023.pdf

https://www.indexbox.io/search/passenger-car-price-puerto-rico