In 2023, Nigeria imported $1.56 billion worth of passenger cars under HS code 8703, per OEC data. This robust demand, driven by a population exceeding 220 million and rapid urbanization, offers substantial revenue potential for U.S. exporters who adeptly manage Nigeria’s levies, compliance, and logistics.

Discover insider logistics hacks for Apapa’s Ro-Ro port, sidestep costly pitfalls, and leverage U.S. auto auctions, where nationwide inventory, transparent grading, and on-site title checks turbocharge your ability to deliver compliant, late-model vehicles for maximum profit.

Key Takeaways

- Market Size & Opportunity: Nigeria imported $1.56 billion in cars in 2023

- Documentation Essentials: From Commercial Invoices to SONCAP Certificates

- Levy Breakdown: Learn to stack Import Duty, Excise, VAT, and IDC correctly

- Cost Modeling: Build precise landed-cost frameworks to ensure profitable pricing

- Sourcing Strategy: Leverage U.S. auctions for nationwide vehicle access and clean titles

Understanding the Nigerian Market

Nigeria’s car-import market reflects economic growth and evolving consumer preferences. With rising disposable incomes, urban dwellers seek reliable, modern vehicles. However, to curb environmental impact and improve road safety, the government enforces a 15-year age cap on imports under KS 1515:2000. Exporters who supply compliant, quality vehicles at competitive landed costs stand to capture this expanding segment.

Regulations & Compliance

Successful clearance hinges on meticulous adherence to both customs and standards regimes:

| Document | Purpose |

| Commercial Invoice | Declares sale price & identifies trading parties |

| Customs Declaration (Form MCS 1) | Registers the vehicle for duty & tax assessment |

| Bill of Lading | Provides proof of sea or air transport |

| Pre-shipment Inspection Certificate | Verifies roadworthiness via SON-appointed body |

| SONCAP Conformity Certificate | Confirms compliance with Nigerian safety standards |

Failing any requirement can result in quarantine, fines, or re-export orders. Always engage KRA‐ and SON‐accredited agents to prepare and verify documents. Sources: Nigeria Customs Service; SONCAP guidelines

Tariffs & Taxes

Nigeria applies multiple levies on imported vehicles. Layering these correctly against your CIF base is critical for margin visibility:

| Levy | Rate | Base |

| Import Duty | 35 % | CIF |

| Excise Duty | 35 % | CIF |

| Value-Added Tax (VAT) | 7.5 % | CIF + Import & Excise Duties |

| Import Declaration Charge | 2 % | CIF |

Understating any component risks cost overruns. Source: Nigeria Customs Service

Crafting Your Landed-Cost Model

Accurate landed-cost projections layer successive levies onto CIF, then add your target markup:

- CIF Base: FOB Purchase + Freight & Insurance

- Import Duty (35 %): 0.35 × CIF

- Excise Duty (35 %): 0.35 × CIF

- VAT (7.5 %): 0.075 × (CIF + Duties)

- IDC (2 %): 0.02 × CIF

Once total landed cost is established, add a 10–15 % profit margin to account for currency risk, handling, and resale overhead.

Main Gateway: Port of Lagos (Apapa)

Nigeria’s busiest port, Apapa handles the bulk of vehicle imports. It offers specialized Ro-Ro terminals, bonded storage, and streamlined customs corridors—but congestion and port charges can erode margins if not planned. Work with experienced NCS‐licensed clearing agents to secure berth slots and expedite inspections.

Common Pitfalls to Avoid

- Levy Miscalculations: Errors compound across layers; always confirm CIF basis and statutory percentages.

- Skipping Pre-shipment Inspections: Customs will hold non-compliant vehicles until certificates appear.

- Incomplete Documentation: A single missing signature or mismatched VIN can trigger detentions.

- Age-cap Violations: Shipments over 15 years old face outright rejection per KS 1515:2000.

Why Auctions Are a Smart Choice for Car Purchases

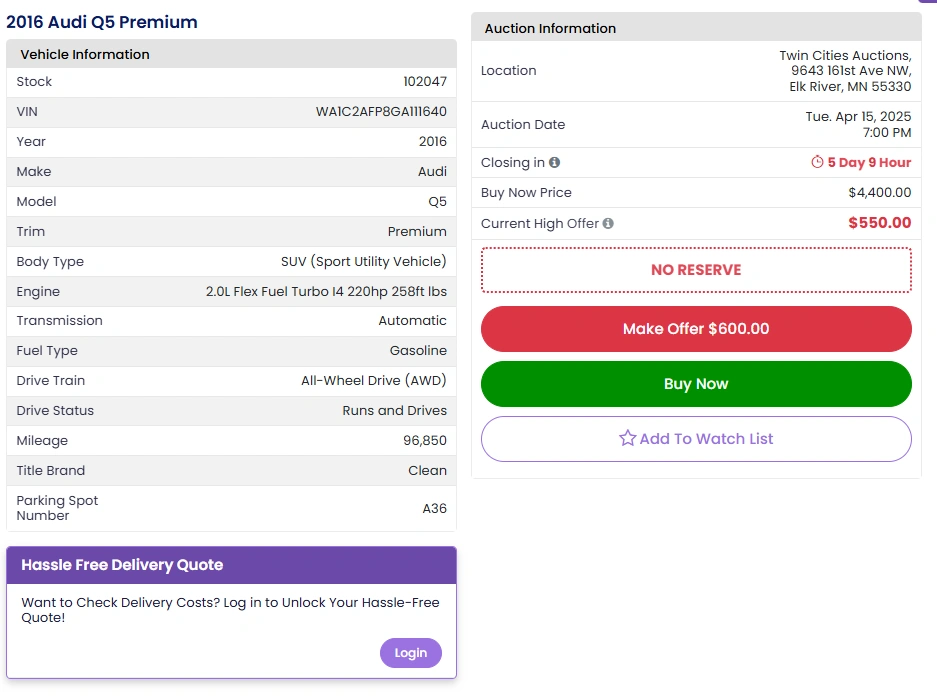

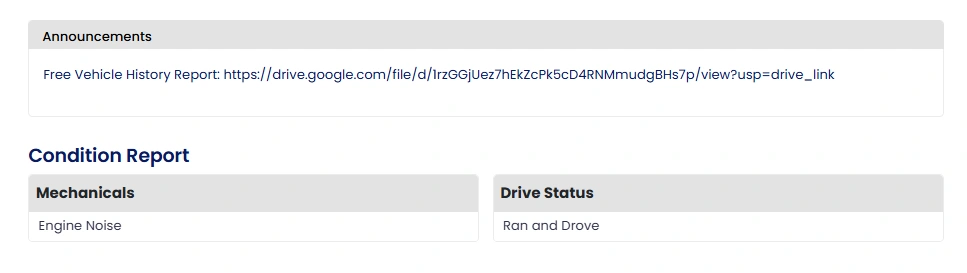

Auctions can be an excellent source for late-model vehicles with clear chains of title and affordable pricing. Twin Cities Auctions, based in Minnesota, is one such reputable auction house that offers a wide range of vehicles at competitive prices.

Key Benefits of Buying from Auctions:

- Wide Selection: Auctions like Twin Cities Auctions offer a variety of vehicles, from low-budget cars to high-end models.

- Competitive Pricing: Auctions often offer vehicles at prices below retail value, enabling dealers to maximize their profit margins.

- Transparency: Auctions provide full vehicle history reports, so you know exactly what you’re buying.

- Convenient Bidding: Many auctions offer online bidding for your convenience, making it easier to source vehicles without being physically present.

Twin Cities Auctions: A Smart Vehicle Sourcing Choice

For those in the automotive industry, Twin Cities Auctions offers an excellent platform for sourcing quality vehicles at competitive prices.

Whether you are just starting or expanding your business, this auction house provides transparency, competitive pricing, and a broad selection.

| Feature | Description |

| Inventory Variety | Wide range of cars, trucks, and SUVs available |

| Competitive Pricing | Below-market pricing allows for higher profit margins |

| Vehicle History Reports | Detailed history reports for every vehicle |

| Online Bidding | Convenient online bidding options for dealers |

| Financing Options | Financing available to help with inventory purchases |

Conclusion

By integrating a precise landed-cost model, ensuring full compliance with KRA and SONCAP mandates, and optimizing your supply through transparent auctions like Twin Cities Auctions, you can tap into Nigeria’s $1.56 billion car-import market profitably and sustainably.

Find Your Next Ride Online at Twin Cities Auctions—No Dealer License Required

Searching for your next vehicle? Twin Cities Auctions offers an online, transparent car auction experience that’s accessible to everyone, no dealer license needed. Browse and bid on a diverse selection of quality vehicles from the comfort of your home.

Whether you’re a first-time buyer or an experienced trader, our clear, honest bidding process ensures you can make informed decisions in a supportive environment. Join our next online auction and discover how effortless and enjoyable finding your next car can be with Twin Cities Auctions!

Looking for more options? Explore our comprehensive list of all available car auctions across the United States. Your next deal might be just a click away!

FAQ

What are Nigeria’s auto import duties?

Import Duty 35 %; Excise Duty 35 %; VAT 7.5 %; Import Declaration Charge 2 % on CIF.

Can I export used cars to Nigeria?

Yes—vehicles up to 15 years old qualify, provided they pass KEBS pre-shipment and SONCAP inspections.

How long does clearance take?

Typically 3–5 business days, depending on port congestion and documentation completeness.

Are older vehicles banned?

Imports older than 15 years are prohibited under KS 1515:2000.

How do I handle rejected shipments?

Engage a licensed clearing agent to correct documentation; budget for any demurrage or re-export costs.

Source Links

https://oec.world/en/profile/bilateral-product/cars/reporter/nga

https://www.indexbox.io/search/passenger-car-price-nigeria/

https://www.export.gov/nigeria-automotive-sector

https://www.soncap.gov.ng

https://www.nigeriacustoms.gov.ng/tariff-schedule