In 2023, Nicaragua imported $183 million worth of passenger cars under HS 8703, an 8.4 % decline from $199 million in 2022. The average CIF price per vehicle was $5 450.

As Nicaragua’s middle class grows and regulators enforce strict age and safety rules, U.S. exporters who master the country’s duties, taxes, and logistics can capture attractive margins by supplying compliant, late-model units.

Key Takeaways

- 2023 imports: $183 M (–8.4 % vs 2022)

- Avg. CIF price: $5 450 per car

- Mandatory docs: Commercial Invoice; Customs Declaration; Bill of Lading; Pre-import Inspection; MITRAB Conformity

- Levies: Import Duty 15 %; Selective Tax 30 %; VAT 13 %

- Key gateway: Port of Corinto handles 70 %+ of imports

- Sourcing strategy: Use U.S. auctions for nationwide inventory, transparent grading, and on-site title checks

Understanding the Nicaraguan Market

Nicaragua’s demand for used vehicles is shaped by practical needs and limited domestic manufacturing, making imports essential to meet consumer and commercial demand. Ride-sharing services and expanding logistics networks have increased appetite for fuel-efficient sedans and light vans.

Buyers tend to prioritize durability, low maintenance, and availability of replacement parts due to service infrastructure constraints.

Importers should also be aware that vehicles with good resale potential, especially Japanese and Korean models, often outperform American brands in this market.

| Year | Import Value (USD M) | % Change vs 2022 |

| 2022 | 199 | — |

| 2023 | 183 | –8.4 % |

| Metric | Figure |

| Avg. CIF Price per Vehicle | $5 450 per unit |

Sources: Trade Data Monitor; IndexBox

Regulations & Compliance

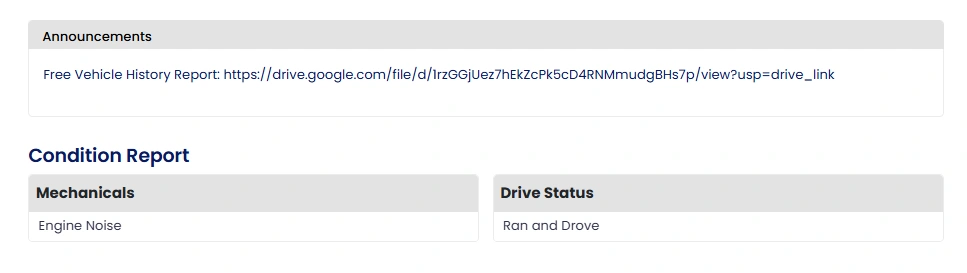

Navigating Nicaraguan import laws requires attention to both customs procedures and labor ministry approvals, which are uniquely enforced. Vehicles must undergo a pre-import safety and emissions inspection conducted by MITRAB-authorized agents before shipping.

Importers should also prepare for occasional on-the-ground verification checks post-arrival, especially if documentation is incomplete or unclear.

Non-compliance with even minor paperwork details can delay clearance significantly and lead to storage or demurrage penalties at port.

- Age Limit: ≤ 5 years from manufacture date; older vehicles are refused.

- Safety & Emissions: Pre-import inspection by a MITRAB-appointed agent checks brakes, lights, and emissions.

- Documentation: Complete, accurate paperwork is mandatory—errors lead to delays and fines.

| Document | Purpose |

| Commercial Invoice | Declares sale price & parties |

| Customs Declaration | Official DTS entry for duty and tax assessment |

| Bill of Lading | Proof of sea or air shipment |

| Pre-import Inspection Certificate | MITRAB-appointed roadworthiness and emissions |

| MITRAB Conformity Certificate | Verifies compliance with labor-ministry regs |

Source: Nicaragua DTS Portal

Tariffs & Taxes

Nicaragua’s tax structure may appear simple but can quickly compound costs if improperly calculated. Each tax layer is sequential and builds on the previous one, significantly increasing the final price if not carefully estimated.

Exporters and dealers should model different price tiers to remain competitive while covering all charges. Customs officers often audit values and documents, so declared CIF prices must reflect fair market estimates to avoid disputes or re-assessments.

| Levy | Rate | Base |

| Import Duty | 15 % | CIF |

| Selective Tax | 30 % | CIF + Import Duty |

| Value-Added Tax | 13 % | CIF + Import Duty + Selective Tax |

Source: Nicaraguan Customs Law

Crafting Your Landed-Cost Model

An accurate model lets you bid and price confidently:

| Cost Component | Calculation Basis |

| CIF Cost | FOB Purchase Price + Freight & Insurance |

| Import Duty (15 %) | 0.15 × CIF |

| Selective Tax (30 %) | 0.30 × (CIF + Import Duty) |

| VAT (13 %) | 0.13 × (CIF + Import Duty + Selective Tax) |

Aim for at least 10–15 % markup on total landed cost to cover handling, clearance, and market fluctuations.

Main Gateway: Port of Corinto

Port of Corinto is not just Nicaragua’s largest port—it’s also its most efficient for vehicle imports due to its specialized auto-handling terminals.

The port’s bonded storage zones offer flexibility in clearing shipments, which can help offset delays from inspection or document reviews.

Ro-Ro is the most common shipping method due to its cost-efficiency, but high-value or non-operational vehicles may be better suited for container transport.

Importers working with local customs agents can often expedite release by pre-clearing documents before vessel arrival.

Common Pitfalls to Avoid

Many exporters underestimate how strict Nicaragua is on paperwork, especially when it comes to inspection and conformity documents.

Errors or missing signatures can result in customs holds, even if the vehicle itself is compliant. Vehicle age rules are aggressively enforced, and any shipment violating the 5-year rule risks full rejection and return at the shipper’s expense.

Another common issue is mislayering the tax calculations, which leads to underpricing and cuts into profit margins—always double-check your formulas before quoting.

| Pitfall | Description |

|---|---|

| Mis-calculating Levies | Layer each tax on the correct CIF base to avoid underpricing and profit loss. |

| Skipping Safety Inspections | A valid pre-import inspection certificate is mandatory for customs clearance. |

| Incomplete Documentation | Paperwork errors or omissions can trigger customs holds, fines, and demurrage. |

| Ignoring Age Limits | Vehicles older than five years are banned and will be returned at your expense. |

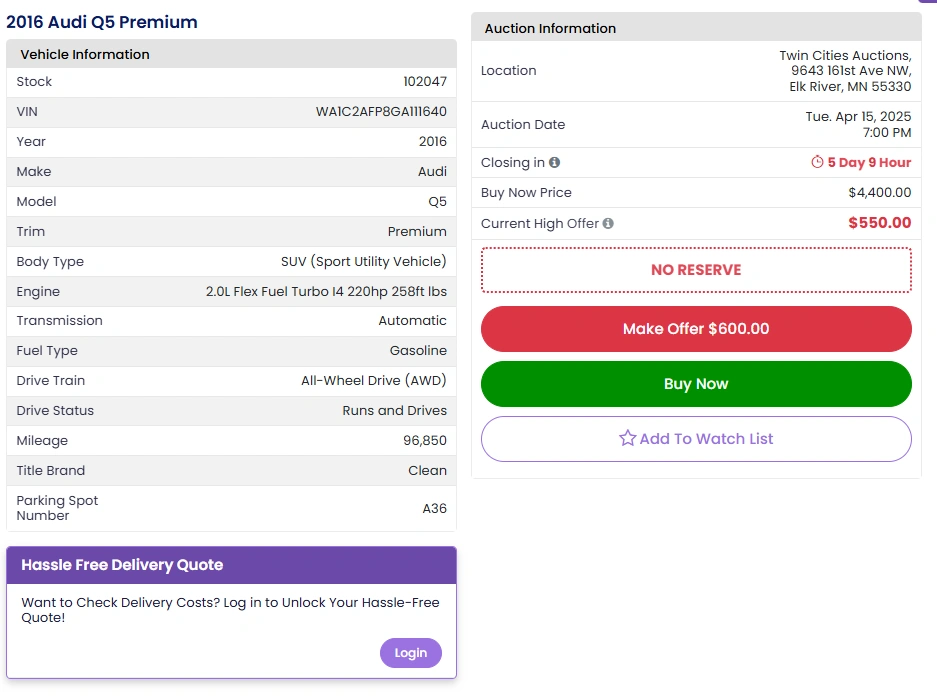

Why Auctions Are a Smart Choice for Car Purchases

Auctions can be an excellent source for late-model vehicles with clear chains of title and affordable pricing. Twin Cities Auctions, based in Minnesota, is one such reputable auction house that offers a wide range of vehicles at competitive prices.

Key Benefits of Buying from Auctions:

- Wide Selection: Auctions like Twin Cities Auctions offer a variety of vehicles, from low-budget cars to high-end models.

- Competitive Pricing: Auctions often offer vehicles at prices below retail value, enabling dealers to maximize their profit margins.

- Transparency: Auctions provide full vehicle history reports, so you know exactly what you’re buying.

- Convenient Bidding: Many auctions offer online bidding for your convenience, making it easier to source vehicles without being physically present.

Twin Cities Auctions: A Smart Vehicle Sourcing Choice

For those in the automotive industry, Twin Cities Auctions offers an excellent platform for sourcing quality vehicles at competitive prices.

Whether you are just starting or expanding your business, this auction house provides transparency, competitive pricing, and a broad selection.

| Feature | Description |

| Inventory Variety | Wide range of cars, trucks, and SUVs available |

| Competitive Pricing | Below-market pricing allows for higher profit margins |

| Vehicle History Reports | Detailed history reports for every vehicle |

| Online Bidding | Convenient online bidding options for dealers |

| Financing Options | Financing available to help with inventory purchases |

Conclusion

By mastering Nicaragua’s regulatory framework, accurately modeling all duties and taxes, and sourcing compliant vehicles via transparent U.S. auctions like Twin Cities Auctions, you can unlock healthy margins in the $183 million Nicaraguan car-import market while minimizing risk.

Twin Cities Auctions: No Dealer License? No Problem!

Are you interested in buying or selling a car but worried about the complexities of needing a dealer license? Worry no more! At Twin Cities Auctions, we’ve removed the barriers, making our auctions open to everyone.

Whether you’re a seasoned buyer or a first-time seller, our platform offers a welcoming environment where you can participate freely. Experience the ease and excitement of our next auction and discover just how simple and rewarding a car auction can be!

Looking for more options? Explore our comprehensive list of all available car auctions across the United States. Your next deal might be just a click away!

FAQ

What are Nicaragua’s auto import levies?

Import Duty 15 %; Selective Tax 30 %; VAT 13 % on the aggregated CIF base.

Can I export used cars to Nicaragua?

Yes; vehicles ≤ 5 years old qualify and must pass a MITRAB pre-import inspection.

How long does customs clearance take?

Typically 2–5 business days once all compliant documentation and certificates are submitted.

Are there emission or safety standards?

Yes; a pre-import inspection certificate covers brakes, lights, and emissions per MITRAB standards.

How do I handle a customs hold?

Engage your clearing agent immediately to correct documentation; budget for any demurrage fees.

Source Links

https://www.tradedatamonitor.com/hs-code-8703/kenya/partner/nicaragua

https://www.indexbox.io/search/passenger-car-price-nicaragua

https://portal.transparency.gob.ni/dts-procedures