In 2023, Kenya imported $378 million worth of passenger cars under HS 8703—a 11.9 % decline from $429 million in 2022—per TrendEconomy.

This contraction, driven by stricter age limits and currency shifts, has sharpened margins for exporters who precisely manage duties, taxes, and logistics.

The following guide unpacks Kenya’s market dynamics, regulatory hurdles, cost structures, and sourcing strategies to help U.S. businesses maximize profitability.

Key Takeaways

A quick overview of the core insights you’ll gain in this guide:

- Import Trends: Kenya’s 2023 car imports fell to $378 M (–11.9 % vs 2022)

- Unit Economics: Average CIF price per vehicle is $6 100

- Documentation: Must include Commercial Invoice, Customs Declaration, Bill of Lading, Pre-shipment Inspection, KEBS Conformity

- Levies: Import Duty 25 %, Excise 20 %, VAT 16 %, IDF 2 %, RDL 1.5 %

- Cost Modeling: Build precise landed-cost frameworks to protect 10–15 % margins

- Sourcing: Transparent U.S. auctions deliver nationwide supply and on-site title checks

Understanding the Kenyan Market

Kenya’s vehicle-import market is shaped by economic trends, regulatory change, and consumer demand. After peaking in 2021, import values and volumes have declined as the government tightened age restrictions to reduce emissions and promote safer vehicles.

Nevertheless, the drop has intensified demand for newer, well-maintained units—creating opportunities for exporters who can deliver compliant, competitively priced inventory.

| Year | Import Value (USD M) | % Change vs Prior Year |

| 2022 | 429 M | — |

| 2023 | 378 M | –11.9 % |

| Metric | Figure |

| Avg. CIF Price per Vehicle | $6 100 per unit |

Sources: TrendEconomy; IndexBox.

Regulations & Compliance

Navigating Kenya’s import framework requires meticulous adherence to KRA and KEBS mandates. HS code 8703 vehicles must pass a KEBS roadworthiness inspection and obtain a Conformity Certificate under KS 1515:2000 (vehicles ≤ 8 years old). Incomplete or incorrect documentation invites fines and delays, so ensure each shipment is accompanied by:

| Document | Purpose |

| Commercial Invoice | Declares sale price & trade parties |

| Customs Declaration (IDF form) | Official entry & levy calculation |

| Bill of Lading | Proof of sea/air shipment |

| Pre-shipment Inspection Certificate | KEBS-appointed roadworthiness check |

| KEBS Conformity Certificate (CoC) | Confirms compliance with national standards |

Sources: Kenya Revenue Authority

Tariffs & Taxes

Kenya imposes multiple layered levies on vehicle imports. Accurately stacking these charges against your CIF base is critical to projecting landed cost:

| Levy | Rate | Base |

| Import Duty | 25 % | CIF |

| Excise Duty | 20 % | CIF + Import Duty |

| Value-Added Tax (VAT) | 16 % | CIF + Import Duty + Excise Duty |

| Import Declaration Fee (IDF) | 2 % | CIF |

| Railway Development Levy (RDL) | 1.5 % | CIF |

Source: Kenya Revenue Authority

Crafting Your Landed-Cost Model

A robust cost model layers each levy onto your CIF base and then adds your target margin. For example:

| Cost Component | Calculation Basis |

| CIF Cost | FOB Price + Freight & Insurance |

| Import Duty (25 %) | 0.25 × CIF |

| Excise Duty (20 %) | 0.20 × (CIF + Import Duty) |

| VAT (16 %) | 0.16 × (CIF + Import Duty + Excise Duty) |

| IDF & RDL (3.5 %) | 0.035 × CIF |

Target a 10–15 % markup on total landed cost to buffer against FX shifts and unexpected expenses.

Top Supplying Countries (2023)

Diversifying sourcing can mitigate geopolitical risk and currency swings. In 2023, Kenya’s top suppliers under HS 8703 were:

| Country | Import Value (USD M) | Share (%) |

| Japan | 261.7 M | 69.0 % |

| South Africa | 32.8 M | 8.65 % |

| UK | 16.5 M | 4.35 % |

| Germany | 14.6 M | 3.87 % |

| Thailand | 13.2 M | 3.49 % |

| India | 9.4 M | 2.47 % |

| USA | 4.2 M | 1.11 % |

Source: TrendEconomy

Main Shipping Gateways

Kenya’s two primary ports—Mombasa and Lamu—serve as the country’s logistics pillars. Mombasa handles the lion’s share of containerized vehicles, while Lamu’s new capacity eases congestion and reduces dwell times, boosting throughput reliability.

Common Pitfalls to Avoid

Even small oversights can derail an export cycle:

- Mis-calculating Levies – Always base each duty/tax on the correct CIF sum.

- Skipping KEBS Inspection – A valid roadworthiness certificate is non-negotiable.

- Incomplete Documentation – Discrepancies lead to holds, fines, and demurrage.

- Ignoring Age Limits – Vehicles over 8 years are banned under KS 1515:2000.

Why Auctions Are a Smart Choice for Car Purchases

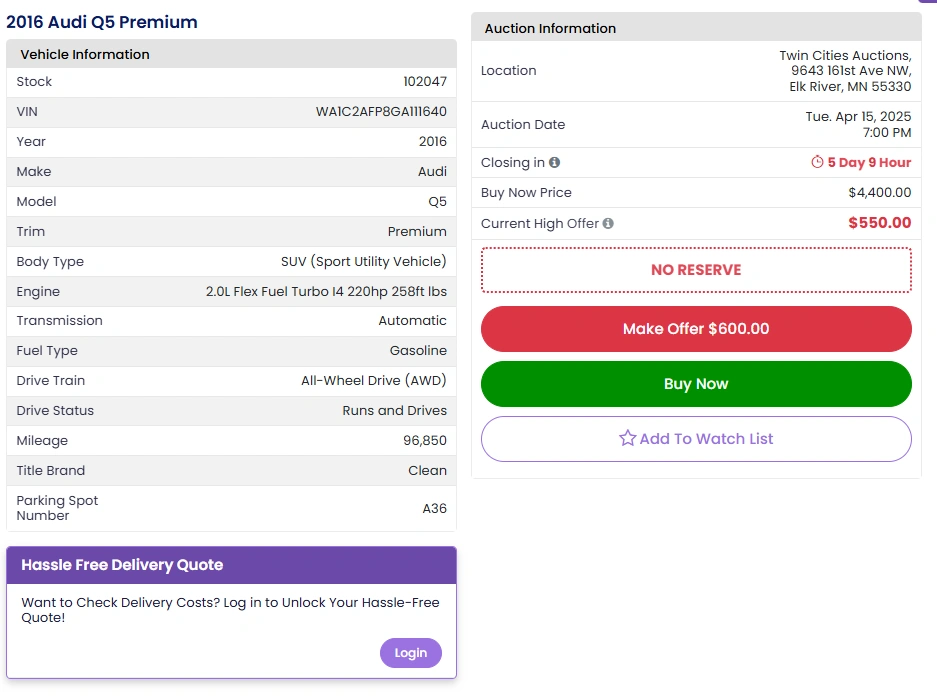

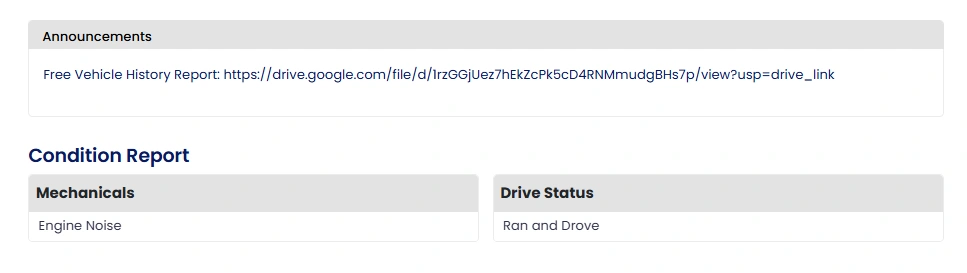

Auctions can be an excellent source for late-model vehicles with clear chains of title and affordable pricing. Twin Cities Auctions, based in Minnesota, is one such reputable auction house that offers a wide range of vehicles at competitive prices.

Key Benefits of Buying from Auctions:

- Wide Selection: Auctions like Twin Cities Auctions offer a variety of vehicles, from low-budget cars to high-end models.

- Competitive Pricing: Auctions often offer vehicles at prices below retail value, enabling dealers to maximize their profit margins.

- Transparency: Auctions provide full vehicle history reports, so you know exactly what you’re buying.

- Convenient Bidding: Many auctions offer online bidding for your convenience, making it easier to source vehicles without being physically present.

Twin Cities Auctions: A Smart Vehicle Sourcing Choice

For those in the automotive industry, Twin Cities Auctions offers an excellent platform for sourcing quality vehicles at competitive prices.

Whether you are just starting or expanding your business, this auction house provides transparency, competitive pricing, and a broad selection.

| Feature | Description |

| Inventory Variety | Wide range of cars, trucks, and SUVs available |

| Competitive Pricing | Below-market pricing allows for higher profit margins |

| Vehicle History Reports | Detailed history reports for every vehicle |

| Online Bidding | Convenient online bidding options for dealers |

| Financing Options | Financing available to help with inventory purchases |

Conclusion

By aligning a precise landed-cost model with strict compliance and leveraging robust Kenyan gateways, U.S. exporters can turn Kenya’s $378 million market into a reliable revenue stream. Sourcing through transparent auctions like Twin Cities Auctions ensures clean titles and condition clarity—the foundation for consistent export success.

Your Next Car is Just a Click Away at Twin Cities Auctions!

Twin Cities Auctions brings the excitement of car auctions directly to your screen. No dealer license? No problem! Our online platform is open to the public, offering a wide range of vehicles to suit all tastes and budgets.

Whether you are an automotive enthusiast or a first-time buyer, you’ll find an impressive variety of vehicles that cater to all tastes and budgets. From reliable family sedans and eco-friendly hybrids to high-performance cars and premium SUVs, our listings are curated to ensure quality and diversity.

Enjoy a hassle-free bidding process and secure your perfect match from our extensive lineup. Don’t miss out—your next car is just a click away at Twin Cities Auctions!

Looking for more options? Explore our comprehensive list of all available car auctions across the United States. Your next deal might be just a click away!

FAQ

What are Kenya’s auto import duties?

Import Duty 25 %, Excise 20 %, VAT 16 %, IDF 2 %, RDL 1.5 % on CIF.

Can I export used cars to Kenya?

Yes; vehicles ≤ 8 years old qualify, subject to KEBS inspection and KS 1515:2000 standards.

How long does clearance take?

Customs release typically occurs within 1–3 business days after submitting compliant documentation.

Are there vehicle age restrictions?

Imports older than 8 years are prohibited per KS 1515:2000.

How do I handle rejected shipments?

Work with your clearing agent to resolve documentation issues and budget for any demurrage fees.

Source Links

https://trendeconomy.com/data/import_h2?commodity=8703&reporter=Kenya&time_period=2023&trade_flow=Import

https://www.indexbox.io/search/passenger-car-price-kenya/

https://www.kra.go.ke/helping-tax-payers/faqs/customs-and-border-control

https://legacy.export.gov/article?id=Kenya-Import-Tariffs-and-Documentation

https://www.kra.go.ke/individual/importing/learn-about-importation/procedures-for-motor-vehicle