Honduras is quickly emerging as a prime destination for used vehicle exports, fueled by rising consumer demand and a steadily recovering economy.

In 2023, the country imported over $212 million worth of passenger vehicles under HS code 8703, marking a 5.2 percent increase from the previous year, according to UN Comtrade.

With an average CIF price of $8,450 per unit, based on IndexBox data, the market presents strong potential for exporters targeting cost-conscious buyers in Central America.

By mastering Honduras’s layered tax structure, including a 15 percent import duty, 15 percent value-added tax, and a 1 percent selective consumption tax on the CIF value, sellers can unlock solid profit margins in a competitive and growing landscape.

Key Takeaways

- 2023 Imports: $212 M in vehicles, up 5.2 % vs. 2022

- Average Price: $8 450 CIF per unit

- Mandatory Docs: Commercial Invoice; Customs Declaration; Bill of Lading; Certificate of Origin; SIC Homologation Certificate

- Levies: 15 % Import Duty; 15 % VAT; 1 % Selective Consumption Tax

- Margins: Target 10–12 % markup over landed cost

- Ports: Puerto Cortés & Puerto Castilla as primary gateways

Understanding the Honduran Market

Honduras’s growing middle class, rising auto-financing options, and tight local assembly capacity drive robust demand for imported vehicles.

Passenger cars account for the majority of HS 8703 imports, especially economy and mid-range SUVs and sedans. The 5.2 % import-value uptick in 2023 reflects both unit growth and slightly higher average CIF values as buyers trade up.

| Metric | 2023 Figure |

| Import Value (HS 8703) | $212 M (↑ 5.2 %) |

| Average CIF Price per Vehicle | $8 450 per unit |

| Primary Segments | Economy sedans; compact & mid-SUVs |

| Growth Drivers | Credit expansion; urbanization |

Regulations & Compliance

Honduran Customs enforces HS 8703 rules alongside homologation by the Secretaría de Industria y Comercio (SIC). Vehicles must comply with local safety and emissions standards. Key documents:

| Document | Purpose |

| Commercial Invoice | Declares transaction value & trade parties |

| Customs Declaration | Formal CIF-based duty/VAT calculation |

| Bill of Lading | Proof of ocean/air shipment |

| Certificate of Origin | Verifies manufacturing country for preferential duty |

| SIC Homologation Certificate | Confirms technical compliance with Honduran norms |

Source: U.S. Export.gov (Honduras)

Tariffs & Taxes

Multiple levies apply to vehicle imports, compounding on CIF:

| Levy | Rate | Base |

| Import Duty | 15 % | CIF |

| Value-Added Tax (VAT) | 15 % | CIF + Import Duty |

| Selective Consumption Tax | 1 % | CIF + Import Duty + VAT |

Source: Honduras Customs Tariff Schedule

Crafting Your Landed-Cost Model

A precise cost model layers each levy onto CIF and adds your target margin:

| Component | Formula |

| CIF Cost | FOB Price + Freight & Insurance |

| Import Duty (15 %) | 0.15 × CIF |

| VAT (15 %) | 0.15 × (CIF + Import Duty) |

| Selective Tax (1 %) | 0.01 × (CIF + Import Duty + VAT) |

| Target Markup (10–12 %) | Applied on total landed cost |

Main Entry Ports

Puerto Cortés is the primary gateway for vehicle imports into Honduras, offering extensive infrastructure, customs processing capabilities, and containerized handling. It’s also known for its relatively efficient turnaround times compared to other Central American ports.

Puerto Castilla, while smaller, is increasingly popular due to its dedicated roll-on/roll-off (Ro-Ro) capabilities, which streamline the unloading of operable vehicles.

Exporters should coordinate early with shipping agents to confirm vessel schedules and understand port-specific handling charges that can affect total delivery costs.

- Puerto Cortés: Honduras’s largest seaport, handles containerized vehicles and general cargo.

- Puerto Castilla: Specialized Ro-Ro terminal optimized for vehicle imports.

(Verify scheduling and port handling fees with your freight forwarder.)

Financing & Payment Security

Securing payment for international exports requires careful financial planning, especially in emerging markets like Honduras. Letters of credit remain the most secure method for new or high-risk clients, offering bank-backed assurance against non-payment.

While open account terms speed up repeat transactions, they should only be used with trusted buyers who have a history of on-time payments.

Exporters dealing with currency fluctuations between the U.S. dollar and Honduran lempira should also consider using FX forward contracts to lock in favorable rates and protect profit margins.

- Letters of Credit: Bank-backed guarantees mitigate payment risk.

- Open Account Terms: Favorable for established, recurring partners.

- Escrow Services: Funds held until documentation and delivery are confirmed.

- FX Forward Contracts: Hedge HNL/USD volatility to protect margins.

Common Pitfalls to Avoid

Many exporters miscalculate import duties and taxes by excluding freight and insurance in the CIF value, leading to underpayment penalties.

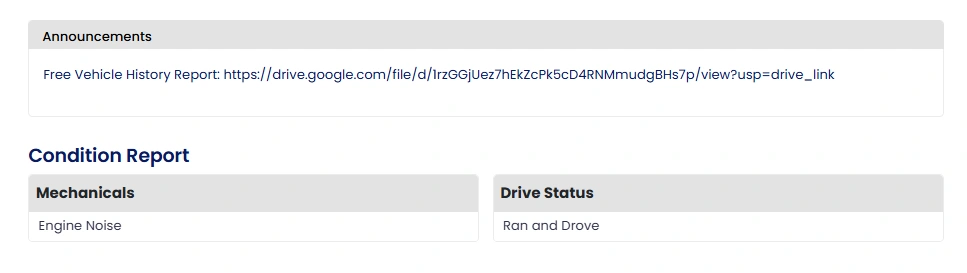

Skipping the homologation process or failing to obtain a valid SIC (certificado de inspección y conformidad) can result in the vehicle being held or rejected at customs. Incomplete paperwork, such as mismatched VINs or missing customs forms, can trigger lengthy delays or fines.

Additionally, failing to understand local buyer preferences may hurt sales. Honduran consumers typically favor fuel-efficient sedans and compact SUVs over trucks or luxury models.

| Common Pitfall | Description |

|---|---|

| Duty & Tax Miscalculations | Always base levies on the correct CIF (Cost, Insurance, Freight) value to avoid underpayment. |

| Skipping Homologation | Failing to secure a SIC (certificado de inspección y conformidad) can result in customs detention. |

| Incomplete Documentation | Errors or missing information may cause fines, delays, or rejection during import processing. |

| Ignoring Segment Preferences | Honduran buyers favor sedans and compact SUVs; source inventory accordingly to match demand. |

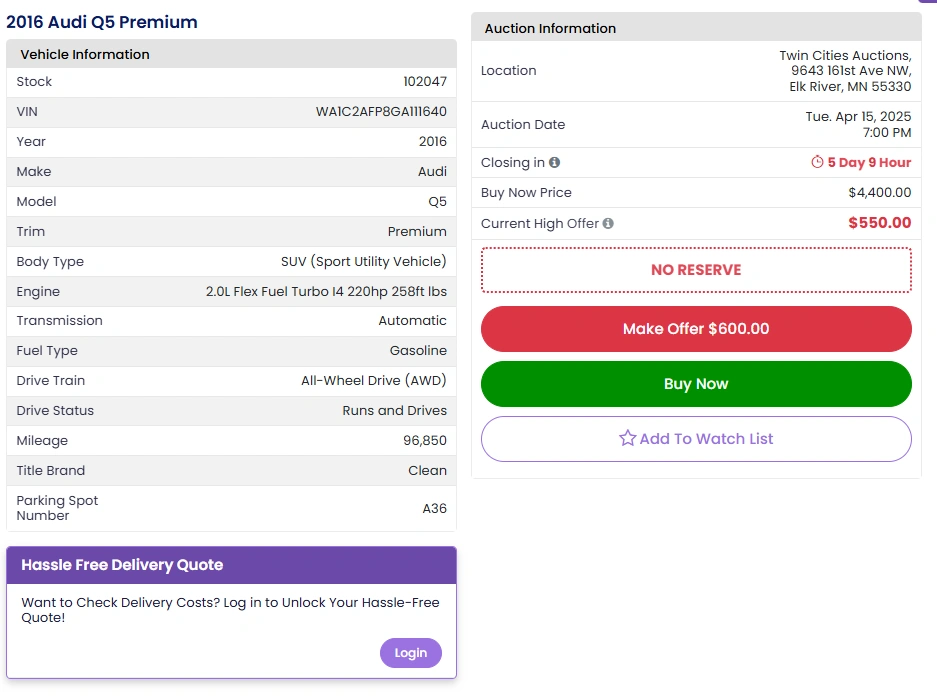

Why Auctions Are a Smart Choice for Car Purchases

Auctions can be an excellent source for late-model vehicles with clear chains of title and affordable pricing. Twin Cities Auctions, based in Minnesota, is one such reputable auction house that offers a wide range of vehicles at competitive prices.

Key Benefits of Buying from Auctions:

- Wide Selection: Auctions like Twin Cities Auctions offer a variety of vehicles, from low-budget cars to high-end models.

- Competitive Pricing: Auctions often offer vehicles at prices below retail value, enabling dealers to maximize their profit margins.

- Transparency: Auctions provide full vehicle history reports, so you know exactly what you’re buying.

- Convenient Bidding: Many auctions offer online bidding for your convenience, making it easier to source vehicles without being physically present.

Twin Cities Auctions: A Smart Vehicle Sourcing Choice

For those in the automotive industry, Twin Cities Auctions offers an excellent platform for sourcing quality vehicles at competitive prices.

Whether you are just starting or expanding your business, this auction house provides transparency, competitive pricing, and a broad selection.

| Feature | Description |

| Inventory Variety | Wide range of cars, trucks, and SUVs available |

| Competitive Pricing | Below-market pricing allows for higher profit margins |

| Vehicle History Reports | Detailed history reports for every vehicle |

| Online Bidding | Convenient online bidding options for dealers |

| Financing Options | Financing available to help with inventory purchases |

Conclusion

Exporting cars to Honduras requires precise landed-cost modeling, strict compliance with duty and tax regulations, and optimized logistics via Puerto Cortés or Castilla.

Leveraging transparent U.S. auctions, such as Twin Cities Auctions, provides reliable sourcing, streamlined due diligence, and clean titles, laying the groundwork for sustainable export profits.

Public Auctions Made Easy with Twin Cities Auctions

At Twin Cities Auctions, we strive to simplify the public auction process for everyone. You don’t need a dealer license to buy or sell cars here. Our online auctions are designed to be user-friendly and open to the public, ensuring that individuals of all experience levels—from novice buyers to experienced sellers—can participate with ease.

With a focus on transparency and ease of use, we provide all the tools and support you need to confidently participate in the auction process. Start your car buying or selling journey with us today and experience how straightforward and effective our auction system can be!

Looking for more options? Explore our comprehensive list of all available car auctions across the United States. Your next deal might be just a click away!

FAQ

What are Honduras’s auto import duties?

Import Duty 15 %; VAT 15 %; Selective Consumption Tax 1 % on CIF.

Can I export used cars to Honduras?

Yes; late-model vehicles (commonly ≤ 5 years old) are allowed post-homologation.

How long does clearance take?

Typically 3–5 business days once all compliant documents are submitted.

Are there vehicle age restrictions?

While no strict age cap exists, SIC homologation standards favor newer models.

How do I handle rejected shipments?

Engage your clearing agent promptly to rectify compliance gaps and budget for detention fees.

Source Links

https://www.indexbox.io/search/passenger-car-price-honduras

https://legacy.export.gov/article?id=Honduras-Import-Tariffs-and-Documentation