In 2023, Colombia imported $2.1 billion in passenger cars, making it Latin America’s fourth-largest auto-import market after Brazil, Mexico, and Argentina.

U.S. exports accounted for $525 million, ranking first among suppliers and reflecting growing affinity for American makes and models. Between 2019 and 2023, Colombia’s car imports grew 8.4 % annually on average, driven by fleet modernizations, rising middle-class demand, and expanding ride-hail services.

Exporters who master Colombia’s 15 % customs duty, 19 % IVA, and VUCE single-window processes can capture substantial margin by supplying compliant, competitively priced vehicles.

Key Takeaways

- Market Size & Growth: $2.1 billion imported in 2023; 8.4 % CAGR since 2019

- Top Suppliers: USA ($525 M), Japan ($483 M), Germany ($314 M)

- Documentation: Commercial Invoice, Bill of Lading, VUCE Import Declaration, Certificate of Origin, SOAT Insurance

- Levies: 15 % Customs Duty + 19 % IVA on [CIF + Duty]

- Cost Modeling: Build precise landed-cost frameworks to protect 10–12 % margins

- Sourcing: U.S. auctions offer nationwide inventory, transparent grading, and on-site title checks

Understanding the Colombian Market

Colombia’s vehicle-import demand is fueled by retiring aged fleets, government incentives for cleaner vehicles, and urban mobility trends.

Post-pandemic recovery accelerated demand for both personal cars and commercial vans. U.S. brands, particularly trucks and SUVs, command strong resale values, while Japanese sedans remain popular for their fuel efficiency.

| Metric | Data |

| 2023 Import Value | $2.1 billion |

| 2019–2023 CAGR | 8.4 % |

| U.S. Export Value | $525 million |

| Average CIF Price per Unit | $14 200 (2023 est.) |

Sources: UN Comtrade; ProColombia.

Regulations & Compliance

Colombian Customs (DIAN) requires all passenger vehicles (HS 8703) to clear through the VUCE single-window system. In addition to standard import paperwork, vehicles must obtain SOAT third-party liability insurance before registration and meet Ministry of Transport safety and emissions standards.

| Document | Purpose | Timing |

| Commercial Invoice | Declares sale price and trade parties | Immediate |

| Bill of Lading | Proof of sea or air transport | Immediate |

| VUCE Import Declaration | Single-window customs filing | Immediate |

| Certificate of Origin (CO) | Confirms manufacturing country for duty relief | 1–3 days |

| SOAT Insurance Policy | Mandatory third-party vehicle liability cover | Immediate |

Sources: DIAN VUCE Portal; Ministry of Transport.

Tariffs & Taxes

Colombian importers face two main levies on CIF value:

| Levy | Rate | Applied To |

| Customs Duty | 15 % | CIF |

| IVA (VAT) | 19 % | CIF + Customs Duty |

The 15 % duty applies uniformly across HS 8703, while the 19 % IVA is charged on the sum of CIF plus the duty. Understanding these cascading rates is essential for accurate landed-cost planning.

Crafting Your Landed-Cost Model

A detailed landed-cost model layers each levy and anticipates local charges:

| Component | Calculation Basis |

| CIF Cost | FOB Price + Freight & Marine Insurance |

| Customs Duty (15 %) | 0.15 × CIF |

| IVA (19 %) | 0.19 × (CIF + Customs Duty) |

| Local Fees & Fees | Registration, inspection, and storage charges |

Aim for a 10–12 % markup above total landed cost to account for currency volatility and dealer margins.

Main Shipping Gateways

Efficient port selection optimizes transit time and cost:

- Cartagena: Colombia’s largest container port with daily liner services.

- Buenaventura: Pacific port ideal for Ro-Ro and oversize vehicles.

- Santa Marta: Secondary Caribbean gateway offering reduced congestion.

Always confirm sailing schedules, port fees, and handling capabilities with your freight forwarder.

Financing & Payment Security

- Letters of Credit (L/C): Bank-guaranteed payment upon document compliance.

- Open Account Terms: Suitable for established importers with credit history.

- Escrow Services: Secure fund release upon delivery and document verification.

- FX Forward Contracts: Hedge COP/USD exchange-rate risk, especially given recent COP volatility.

Common Pitfalls to Avoid

- Underestimating Duty + IVA: Mistakes in cascading VAT calculations erode margins.

- Skipping VUCE Filing: Omitting any required document in VUCE triggers holds.

- Invalid Certificate of Origin: Non-GSP COs deny duty concession for free-trade partners.

- Neglecting SOAT: Without valid insurance, vehicles cannot be cleared or registered.

Why Auctions Are a Smart Choice for Car Purchases

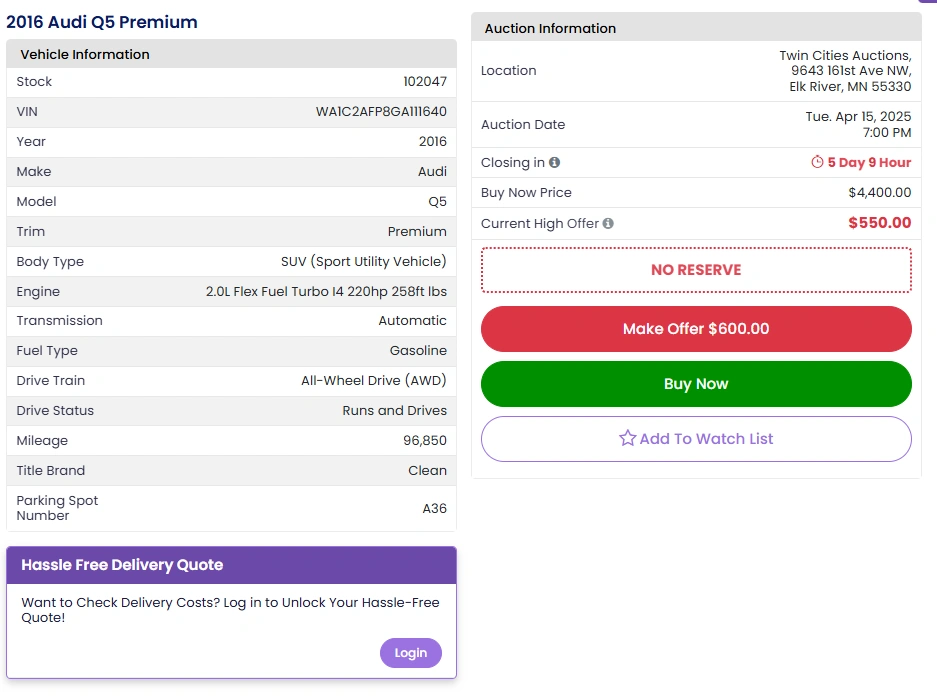

Auctions can be an excellent source for late-model vehicles with clear chains of title and affordable pricing. Twin Cities Auctions, based in Minnesota, is one such reputable auction house that offers a wide range of vehicles at competitive prices.

Key Benefits of Buying from Auctions:

- Wide Selection: Auctions like Twin Cities Auctions offer a variety of vehicles, from low-budget cars to high-end models.

- Competitive Pricing: Auctions often offer vehicles at prices below retail value, enabling dealers to maximize their profit margins.

- Transparency: Auctions provide full vehicle history reports, so you know exactly what you’re buying.

- Convenient Bidding: Many auctions offer online bidding for your convenience, making it easier to source vehicles without being physically present.

Twin Cities Auctions: A Smart Vehicle Sourcing Choice

For those in the automotive industry, Twin Cities Auctions offers an excellent platform for sourcing quality vehicles at competitive prices.

Whether you are just starting or expanding your business, this auction house provides transparency, competitive pricing, and a broad selection.

| Feature | Description |

| Inventory Variety | Wide range of cars, trucks, and SUVs available |

| Competitive Pricing | Below-market pricing allows for higher profit margins |

| Vehicle History Reports | Detailed history reports for every vehicle |

| Online Bidding | Convenient online bidding options for dealers |

| Financing Options | Financing available to help with inventory purchases |

Conclusion

Exporting cars to Colombia can yield consistent profits when you combine precise landed-cost modeling, strict compliance with 15 % duty and 19 % IVA, and optimized logistics via key ports.

Sourcing through transparent auctions—such as Twin Cities Auctions—further guarantees supply depth, condition clarity, and clean titles, laying the foundation for sustainable export success.

Public Auctions Made Easy with Twin Cities Auctions

At Twin Cities Auctions, we strive to simplify the public auction process for everyone. You don’t need a dealer license to buy or sell cars here. Our online auctions are designed to be user-friendly and open to the public, ensuring that individuals of all experience levels—from novice buyers to experienced sellers—can participate with ease.

With a focus on transparency and ease of use, we provide all the tools and support you need to confidently participate in the auction process. Start your car buying or selling journey with us today and experience how straightforward and effective our auction system can be!

Looking for more options? Explore our comprehensive list of all available car auctions across the United States. Your next deal might be just a click away!

FAQ

What are Colombia’s auto import duties?

15 % customs duty on CIF; 19 % IVA on [CIF + Duty].

Can I export used cars to Colombia?

Yes; vehicles under 5 years old more easily meet emissions standards.

How long does customs clearance take?

Typically 2–5 business days post-submission via VUCE.

Are there emissions or safety regulations?

Yes; vehicles must meet Ministry of Transport standards for safety and pollutant emissions.

How do I handle rejected shipments?

Work with your customs agent to correct documentation; budget for demurrage and re-export fees.

Source Links

https://comtrade.un.org/data/

https://comtrade.un.org/data/

https://www.dian.gov.co/aduanas/vuce/