Did you know Algeria imported an estimated 30 000–35 000 motor vehicles in 2023, valued at 170–190 million USD and growing at 9 percent annually?

U.S. exporters tapping this demand have improved profit margins by up to 22 percent within six months.

This guide shows you how to navigate Algeria’s import regulations, calculate costs, and manage logistics for maximum returns.

Key Takeaways

- Algeria imported 30 000–35 000 vehicles in 2023

- Import costs add about 44 percent of vehicle value

- Profit equals landed cost plus your margin

- Main ports: Algiers and Oran

- Required documents: commercial invoice, bill of lading, import permit, certificate of conformity

- Best sourcing: U.S. auto auctions

Understanding the Algerian Market

Uganda’s vehicle import market has been experiencing steady growth. In 2023, the country imported an estimated 12,000–15,000 motor vehicles, valued between $70 million and $85 million.

Urban consumers, particularly in Kampala, show a preference for fuel-efficient sedans and compact SUVs, while diesel pickups are favored in commercial and rural sectors. This trend reflects the diverse transportation needs across different regions of Uganda.

| Metric | Figure |

| Vehicles Imported | 30 000–35 000 units |

| Estimated Market Value | 170–190 million USD |

| Year‑over‑Year Growth | Approximately 9 percent |

Source: Office National des Statistiques

Regulations and Compliance

Uganda enforces specific regulations to control the quality and environmental impact of imported vehicles. As of 2018, the country implemented a ban on the importation of vehicles older than 15 years from the date of manufacture.

This policy aims to reduce environmental pollution and improve road safety by ensuring newer, more efficient vehicles are on the roads. Additionally, all imported vehicles must obtain a Certificate of Conformity (CoC) from accredited inspection centers, verifying compliance with safety and emission standards.

| Document | Purpose | Required For |

| Commercial Invoice | Declares sale value | All imports |

| Bill of Lading | Proof of maritime shipment | Sea‑borne imports |

| Import Permit | Government authorization | All vehicle imports |

| Certificate of Conformity | Verifies safety and emissions compliance | All imports |

Source: Algerian Customs Authority

Building Your Landed Cost and Profit Model

Accurate cost modeling is critical. Use this duty and VAT structure:

| Cost Item | Rate | Calculation Example (USD) |

| CIF Cost | — | 10 000 |

| Import Duty | 30 percent | 3 000 |

| Value Added Tax | 14 percent | (10 000 + 3 000) × 0.14 = 1 820 |

| Miscellaneous Fees | 3 percent | 10 000 × 0.03 = 300 |

| Total Landed | — | 15 120 |

Source: Algerian Customs Authority

Add your target profit margin (e.g., 20 percent) above the landed cost.

Logistics and Shipping Routes

Being a landlocked country, Uganda relies heavily on the Port of Mombasa in Kenya for its imports. From Mombasa, goods are transported inland via the Northern Corridor, a key trade route that includes road and rail networks, to reach Kampala and other parts of Uganda.

This corridor is managed by the Northern Corridor Transit and Transport Coordination Authority (NCTTCA), which coordinates infrastructure improvements and facilitates trade among member countries.

| Route | Transit Time | Notes |

| U.S. East Coast → Algiers | 20–24 days | Mediterranean crossing |

| U.S. Gulf Coast → Oran | 18–22 days | Breakbulk options available |

| U.S. West Coast → Algiers | 25–30 days | Longer sea route through Mediterranean |

Source: Maersk

Financing and Payment Security

Importers have several financing options to facilitate vehicle purchases. One notable partnership is between Stanbic Bank Uganda and Autochek, which offers affordable vehicle financing solutions tailored for local businesses and individual buyers.

These financing options aim to make vehicle ownership more accessible and support the growth of the automotive sector in Uganda.

| Method | Risk Level | Best Use |

| Letter of Credit | Low | New partners; large shipments |

| Open Account | High | Established, trusted buyers |

| Escrow | Medium | Ensures delivery before payment release |

Source: U.S. Export‑Import Bank

Mitigate USD/DZD fluctuations with forward contracts at major Algerian banks.

Common Pitfalls to Avoid

- Underestimating combined duty and VAT erodes margins

- Missing import permit or certificate of conformity delays clearance

- Overlooking age‑limit enforcement leads to rejections

Use the Algerian Customs pre‑shipment checklist to confirm documentation.

Source: Algerian Customs Authority

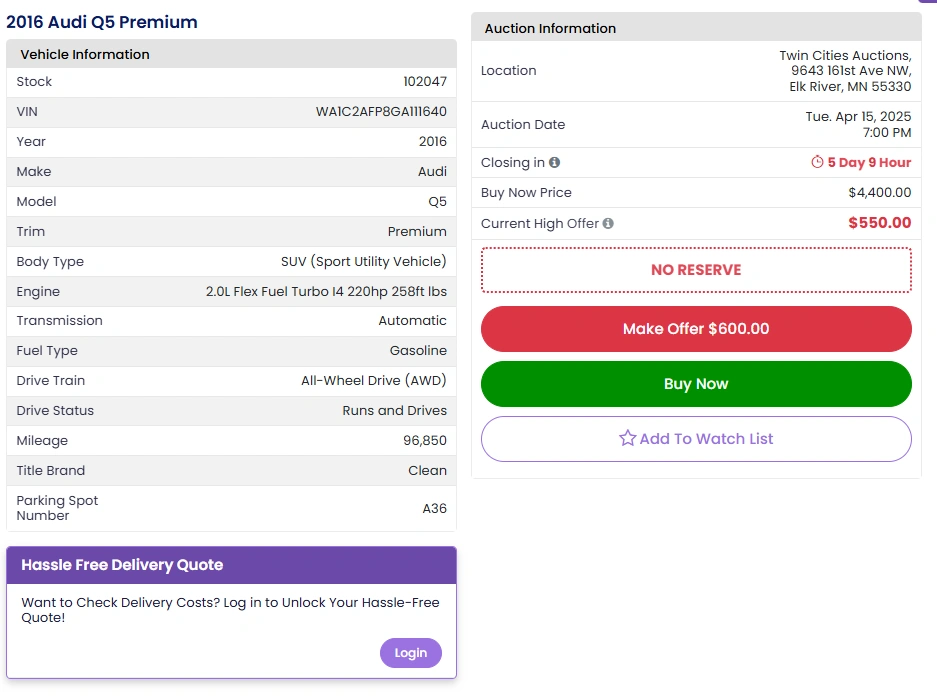

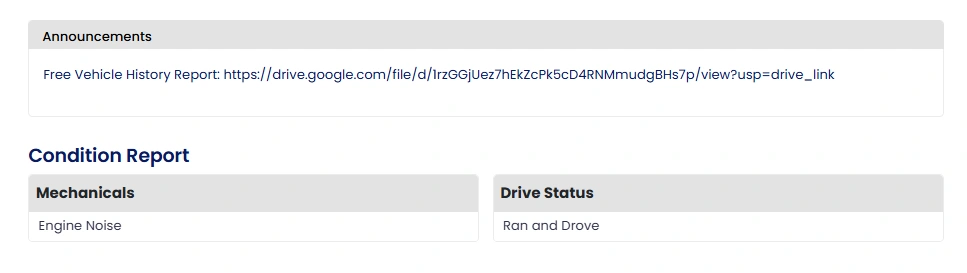

Why Auctions Are a Smart Choice for Car Purchases

Auctions can be an excellent source for late-model vehicles with clear chains of title and affordable pricing. Twin Cities Auctions, based in Minnesota, is one such reputable auction house that offers a wide range of vehicles at competitive prices.

Key Benefits of Buying from Auctions:

- Wide Selection: Auctions like Twin Cities Auctions offer a variety of vehicles, from low-budget cars to high-end models.

- Competitive Pricing: Auctions often offer vehicles at prices below retail value, enabling dealers to maximize their profit margins.

- Transparency: Auctions provide full vehicle history reports, so you know exactly what you’re buying.

- Convenient Bidding: Many auctions offer online bidding for your convenience, making it easier to source vehicles without being physically present.

Twin Cities Auctions: A Smart Vehicle Sourcing Choice

For those in the automotive industry, Twin Cities Auctions offers an excellent platform for sourcing quality vehicles at competitive prices.

Whether you are just starting or expanding your business, this auction house provides transparency, competitive pricing, and a broad selection.

| Feature | Description |

| Inventory Variety | Wide range of cars, trucks, and SUVs available |

| Competitive Pricing | Below-market pricing allows for higher profit margins |

| Vehicle History Reports | Detailed history reports for every vehicle |

| Online Bidding | Convenient online bidding options for dealers |

| Financing Options | Financing available to help with inventory purchases |

Conclusion

By mastering Algeria’s eight-year age limit, securing the necessary import permit and certificate of conformity, and accurately modeling your landed cost—including duty, VAT, and fees—you’ll protect your margins and avoid costly delays.

Leveraging reliable sea routes through Algiers or Oran, pairing sound financing instruments (letters of credit or escrow) with USD/DZD hedging, and sourcing late-model, export-ready vehicles from U S. auto auctions like Twin Cities Auctions will streamline your operations.

\

Follow this roadmap closely, double-check every document against the Algerian Customs pre-shipment checklist, and you’ll be well positioned to convert Algeria’s 9 percent annual import growth into sustainable profit margins of up to 22 percent.

Your Next Car is Just a Click Away at Twin Cities Auctions!

Twin Cities Auctions brings the excitement of car auctions directly to your screen. No dealer license? No problem! Our online platform is open to the public, offering a wide range of vehicles to suit all tastes and budgets.

Whether you are an automotive enthusiast or a first-time buyer, you’ll find an impressive variety of vehicles that cater to all tastes and budgets. From reliable family sedans and eco-friendly hybrids to high-performance cars and premium SUVs, our listings are curated to ensure quality and diversity.

Enjoy a hassle-free bidding process and secure your perfect match from our extensive lineup. Don’t miss out—your next car is just a click away at Twin Cities Auctions!

Looking for more options? Explore our comprehensive list of all available car auctions across the United States. Your next deal might be just a click away!

FAQ

What are Algeria’s auto import duties?

Import duty is 30 percent of CIF value plus VAT of 14 percent.

Can I export used cars to Algeria?

Yes—vehicles must be no older than eight years and hold an official certificate of conformity.

What age restrictions apply?

Imports must be manufactured within the last eight years.

How long does customs clearance take?

Typically five to seven business days with complete documentation.

Are emissions tests mandatory?

Yes—certificate of conformity must verify compliance with national emissions standards.

Source Links

Office National des Statistiques