Imagine driving your dream car, purchased at an auction, across the borders of Canada or Mexico. The thrill of owning a vehicle from an auction is undeniable, but navigating the complex world of international car importation can be daunting.

Whether you’re a seasoned car enthusiast or a first-time buyer, understanding the customs and duties involved in importing auction cars to Canada and Mexico is crucial.

In this article, we’ll delve into the specifics of importing vehicles from auctions to these countries, highlighting key aspects such as Twin Cities Auctions and providing a detailed comparison of the processes involved.

Key Takeaways:

- Canada: Import duties for non-U.S. vehicles are 6.1%, with additional taxes like GST/HST and PST. Vehicles must comply with Canadian safety standards unless they are over 15 years old.

- Mexico: Vehicles manufactured in North America can enter with a 10% preferential tariff. Additional taxes include VAT and ISTUV. Importing requires hiring a customs agent.

Importing Auction Cars

The world of car auctions is vibrant and exciting, offering a wide range of vehicles at competitive prices. However, when it comes to importing these cars across international borders, the process becomes more complex.

Both Canada and Mexico have specific regulations and fees associated with importing vehicles, which can significantly impact the overall cost and legality of your purchase.For instance, did you know that Canada exempts U.S.-made vehicles from import duties due to trade agreements?

Meanwhile, Mexico requires vehicles to meet certain emissions standards and imposes a preferential tariff for North American-made vehicles. Understanding these nuances is essential for a smooth import process.

Why Import from Auctions?

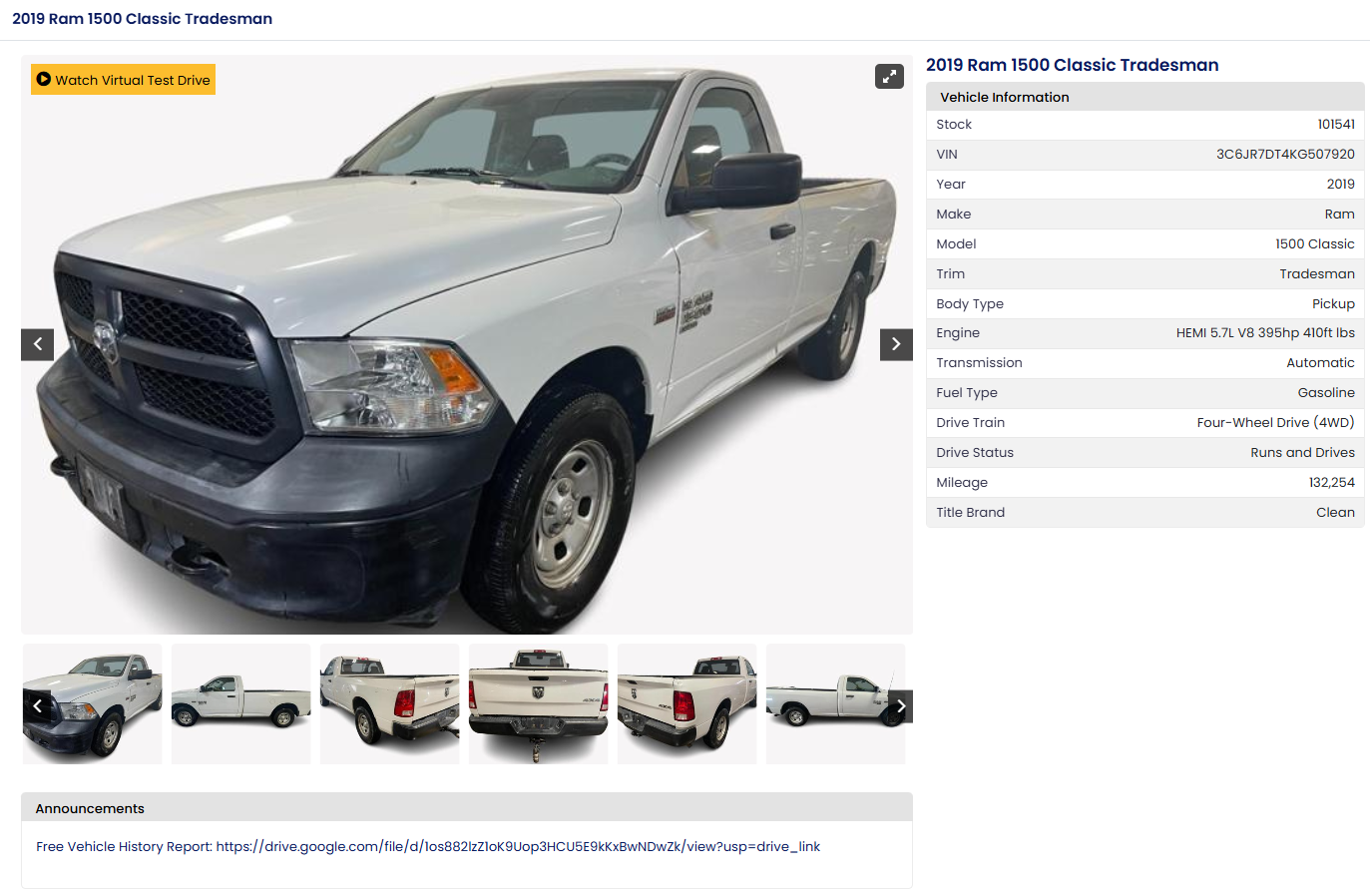

Auctions provide a unique opportunity to purchase vehicles at potentially lower prices than traditional dealerships.

Platforms like Twin Cities Auctions make it easier for individuals to participate in auctions without needing a dealer’s license, opening up the market to a broader audience.

Importing Auction Cars to Canada

Importing a vehicle to Canada involves several steps and costs. Here’s a breakdown of what you need to know:

Duties and Taxes

- Import Duties: Vehicles originating outside the U.S. are subject to a 6.1% duty. U.S.-made vehicles are exempt due to trade agreements.

- Taxes: You’ll need to pay federal and provincial taxes, including GST/HST and PST (or QST in Quebec).

- RIV Registration Fee: A mandatory fee for registering your vehicle with the Registrar of Imported Vehicles.

- Excise Tax: A CAD 100 excise tax applies to vehicles equipped with air conditioning.

- Inspection Fees: Mandatory inspection fees at an authorized RIV facility.

Compliance with Safety Standards

Vehicles must comply with Canadian Motor Vehicle Safety Standards (CMVSS) unless they are over 15 years old, in which case they are exempt. This exemption is particularly beneficial for those interested in importing classic cars.

Steps to Import a Vehicle to Canada

- Ensure Compliance: Verify that your vehicle meets Canadian safety standards or is exempt.

- Obtain Necessary Documents: Secure a U.S. or foreign safety certification label and a recall clearance letter.

- Pay Duties and Taxes: Clear customs by paying applicable duties and taxes.

- Register with RIV: Complete the RIV inspection and registration process within 45 days.

Importing Auction Cars to Mexico

Mexico has its own set of regulations and fees for importing vehicles. Here’s what you need to know:

Duties and Taxes

- Preferential Tariff: Vehicles manufactured in North America are eligible for a 10% preferential tariff.

- VAT (Value Added Tax): 16% of the vehicle’s value, reduced to 8% for residents near the U.S. border.

- ISTUV (Tax on the Use of Vehicles): Additional tax based on the vehicle’s value.

- Customs Procedure Fee (DTA): A fee of 8 per thousand, with a minimum of $258.91.

Compliance with Emissions Standards

Vehicles must meet Mexico’s emissions standards. A Certificate of Pollutant or Gas Emissions is required.

Steps to Import a Vehicle to Mexico

- Hire a Customs Agent: Mandatory for facilitating the import process.

- Obtain Necessary Documents: Secure a title deed and ensure the vehicle meets emissions standards.

- Pay Duties and Taxes: Clear customs by paying applicable duties and taxes.

- Register the Vehicle: Register your vehicle at the Public Vehicle Registry.

Twin Cities Auctions: A Platform for Everyone

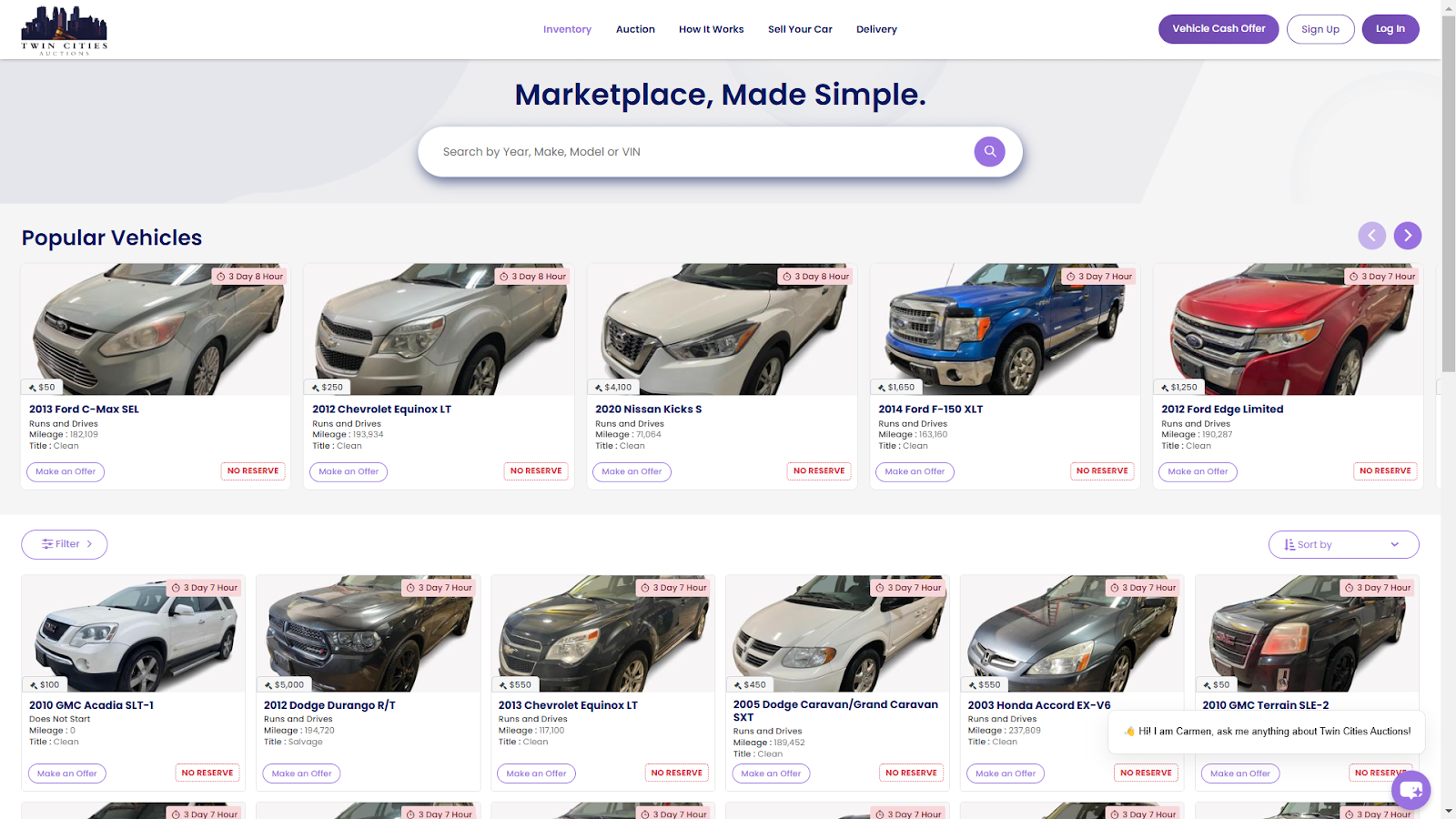

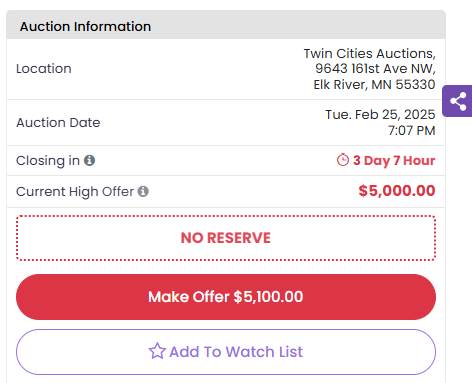

Twin Cities Auctions stands out as an accessible online platform for buying and selling vehicles. Unlike traditional auction houses that often require a dealer’s license, Twin Cities Auctions is open to everyone. This inclusivity makes it an attractive option for both seasoned collectors and first-time buyers.

Key Advantages of Twin Cities Auctions

- Accessibility: No dealer’s license is required to participate.

- User-Friendly Platform: Offers intuitive navigation and comprehensive vehicle information.

- Real-Time Updates: Provides real-time auction updates to keep buyers informed.

- Transparent Bidding: Ensures safe and transparent bidding practices.

How Twin Cities Auctions Works

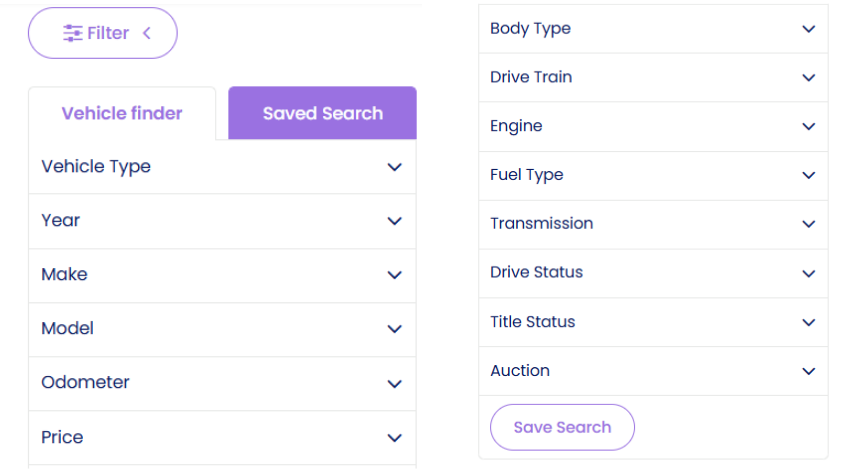

- Browse Inventory: Use filters to find vehicles by year, make, model, and more.

- Bid and Purchase: Participate in auctions with real-time updates.

- Finalize Transaction: Complete the purchase process securely.

Comparison of Importing Auction Cars to Canada and Mexico

| Aspect | Canada | Mexico |

| Import Duties | 6.1% for non-U.S. vehicles | 10% preferential tariff for North American vehicles |

| Taxes | GST/HST, PST/QST | VAT (16% or 8%), ISTUV |

| Safety/Emissions Standards | CMVSS compliance required unless over 15 years old | Emissions standards must be met |

| Customs Agent Requirement | Not required | Mandatory |

| Vehicle Age Limit | No specific age limit for import | Generally, vehicles over 8 years old are restricted |

Conclusion

Importing auction cars to Canada and Mexico can be a rewarding experience, but it requires careful planning and adherence to local regulations. By understanding the duties, taxes, and compliance requirements for each country, you can navigate the process with confidence.

Whether you’re a seasoned collector or a first-time buyer, platforms like Twin Cities Auctions offer accessible and user-friendly ways to participate in auctions.

Remember, the key to a successful import is thorough preparation and compliance with local laws.

Your Next Car is Just a Click Away at Twin Cities Auctions!

Twin Cities Auctions brings the excitement of car auctions directly to your screen. No dealer license? No problem! Our online platform is open to the public, offering a wide range of vehicles to suit all tastes and budgets.

Whether you are an automotive enthusiast or a first-time buyer, you’ll find an impressive variety of vehicles that cater to all tastes and budgets. From reliable family sedans and eco-friendly hybrids to high-performance cars and premium SUVs, our listings are curated to ensure quality and diversity.

Enjoy a hassle-free bidding process and secure your perfect match from our extensive lineup. Don’t miss out—your next car is just a click away at Twin Cities Auctions!

FAQs

What are the import duties for vehicles in Canada?

Import duties in Canada are 6.1% for vehicles originating outside the U.S., while U.S.-made vehicles are exempt.

Can I import a vehicle to Mexico without a customs agent?

No, hiring a customs agent is mandatory for importing vehicles to Mexico.

What is the preferential tariff for importing vehicles to Mexico?

The preferential tariff for vehicles manufactured in North America is 10%.

Do I need a dealer’s license to participate in Twin Cities Auctions?

No, Twin Cities Auctions is open to everyone without requiring a dealer’s license.

What taxes do I need to pay when importing a vehicle to Canada?

You need to pay federal and provincial taxes, including GST/HST and PST (or QST in Quebec).

Can I import a vehicle over 15 years old to Canada without complying with safety standards?

Yes, vehicles over 15 years old are exempt from complying with Canadian Motor Vehicle Safety Standards.

How long does a Temporary Import Permit (TIP) last in Mexico?

A TIP is valid for up to 180 days.

Can I import a vehicle to Mexico if it is over 8 years old?

Generally, vehicles over 8 years old are restricted from import, with some exceptions for classic cars.

Source Links

https://crimsonlogic-northamerica.com/how-to-import-vehicles-to-canada

https://www.trafimar.com.mx/blog_en/how-to-import-vehicles-to-mexico-and-their-customs-requirements

https://blog.twincitiesautoauctions.com/buy-american-cars-export-mexico-guide/

https://tc.canada.ca/en/road-transportation/importing-vehicle/importing-vehicle-united-states-mexico

https://www.expatinsurance.com/articles/taking-car-mexico-permanently-import-car-mexico