In 2023, Panama imported 1 252 million USD worth of passenger cars, according to UN Comtrade. U.S. shipments accounted for ≈25 % of that value, driven by strong demand for late‑model sedans and SUVs.

To capitalize on this market, exporters must adhere to Panama’s import rules, accurately model landed costs under a 15 % duty and 7 % VAT regime, and optimize logistics via Balboa and Cristóbal ports.

Key Takeaways

- 2023 Imports: $1 252 M USD of passenger cars

- U.S. Share: ~25 % of Panama’s car imports

- Mandatory Documents: Commercial Invoice; Customs Declaration; Bill of Lading; Certificate of Origin; Safety Inspection Report

- Levies: 15 % Customs Duty + 7 % VAT on CIF

- Landed‑Cost Model: CIF + Duty + VAT → + target margin

- Main Ports: Balboa (Pacific) and Cristóbal (Atlantic)

Panama’s Passenger‑Car Import Market

Panama is uniquely positioned as a regional trade and logistics hub, thanks to the Panama Canal and its free trade zones. The country serves not only its domestic market but also acts as a transshipment point for neighboring countries.

Its growing middle class continues to drive demand for affordable used vehicles, particularly compact sedans and SUVs. U.S. car exporters benefit from Panama’s familiarity with American vehicles and favorable import practices.

- Import Value: $1 252 M USD under HS 8703

- U.S. Exports: $313 M USD (25 % share)

Regulations & Compliance

While Panama’s import process is streamlined, compliance with its strict documentation standards is essential to avoid costly delays. All vehicles must pass a roadworthiness inspection aligned with AMPATEL standards, especially for used cars.

The Certificate of Origin is critical for verifying eligibility for trade agreements such as DR-CAFTA, which may offer duty exemptions.

Importers should work closely with customs brokers to ensure all electronic submissions are properly formatted and submitted on time.

| Document | Purpose |

| Commercial Invoice | Declares sale price & parties |

| Customs Declaration | Official import entry & duty record |

| Bill of Lading | Proof of shipment |

| Certificate of Origin | Verifies manufacturer country |

| Safety Inspection Report | Confirms roadworthiness per AMPATEL |

Source: Panama Trade Guide (U.S. Commercial Service)

Tariffs & Taxes

Panama applies a relatively straightforward tariff system, but the total import tax burden can surprise first-time exporters.

The 15% customs duty applies to the CIF value, which includes freight and insurance—not just the FOB sale price.

The 7% value-added tax (VAT) is then added to that total, effectively compounding the cost. Vehicles with incomplete paperwork or inaccurate valuations may be reassessed, leading to delays and extra charges.

| Levy | Rate | Base |

| Customs Duty | 15 % | CIF |

| Value‑Added Tax | 7 % | CIF + Duty |

Source: Panama Customs Authority

Crafting Your Landed‑Cost Model

Accurate landed-cost calculations are essential for setting competitive resale prices and protecting margins. Exporters must include all expenses—FOB price, ocean freight, marine insurance, customs duty, and VAT—to understand true import cost.

A healthy target margin typically ranges from 10% to 15% above landed cost to remain profitable while accommodating market pricing.

Currency fluctuations and fuel surcharges can also impact final cost, so periodic updates to cost models are advised.

- CIF Cost: FOB + Freight + Insurance

- Customs Duty (15 %): 0.15 × CIF

- VAT (7 %): 0.07 × (CIF + Duty)

- Target Margin: e.g. 10 – 15 % over landed cost

Logistics & Port Gateways

Panama’s dual-coast port system simplifies shipment routing based on the vehicle’s origin or its final destination within the region.

The Port of Balboa connects efficiently with Asia and the U.S. West Coast, while Cristóbal on the Atlantic side is ideal for U.S.

East Coast and Caribbean-bound shipments. Both ports handle Ro-Ro and container cargo, but not all carriers operate from both terminals—so confirm in advance.

Efficient port operations and a free trade zone make logistics smooth for experienced exporters.

- Balboa (Pacific): Main container & Ro‑Ro terminal

- Cristóbal (Atlantic): Key for Atlantic‑bound shipments

Common Pitfalls to Avoid

One of the most common mistakes exporters make is miscalculating the CIF value by omitting marine insurance—an essential component of Panama’s import valuation.

Exporters also frequently send incomplete documentation, such as missing safety inspection reports or a non-compliant Bill of Lading.

These oversights can delay customs clearance or cause authorities to hold vehicles at the port. Familiarity with local import standards and working with vetted shipping partners helps prevent these problems.

| Common Export Errors | Impact | Prevention Tips |

|---|---|---|

| Incomplete or missing documentation | Delays in customs clearance; possible port holds | Double-check all required paperwork before shipment |

| Incorrect or underreported CIF value | Customs fines or revaluation; higher final costs | Accurately calculate CIF, including freight and insurance |

| Missing safety inspection report | Vehicle cannot be registered or cleared | Ensure inspection is completed and documented before shipping |

| Unfamiliarity with Panama’s import standards | Legal issues; added costs or shipment rejections | Consult with a customs broker or local partner for compliance guidance |

| Using unverified shipping partners | Delays, miscommunication, or lost cargo | Work only with vetted, experienced logistics providers |

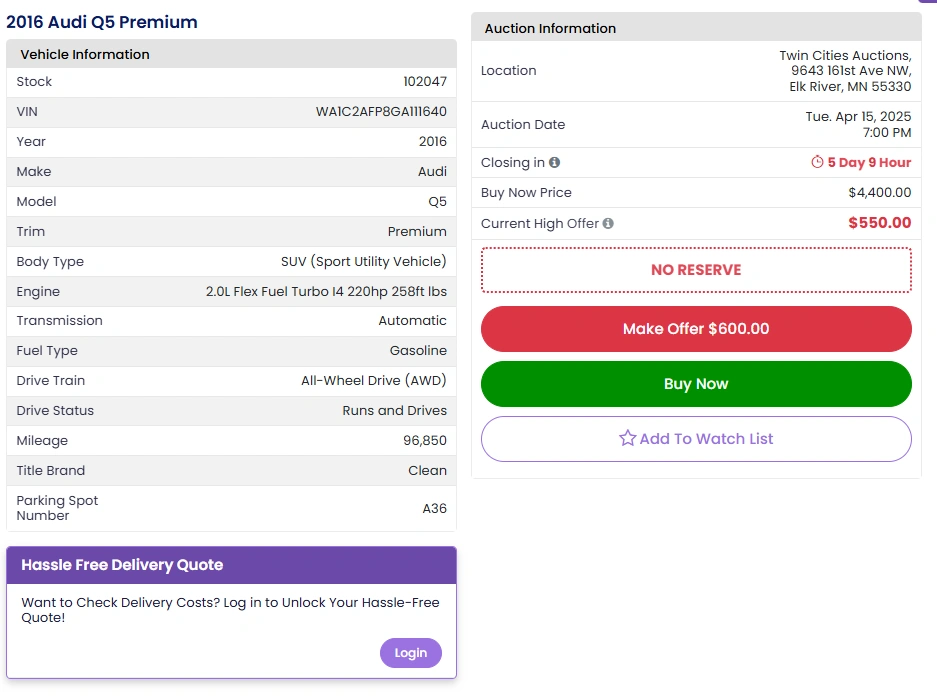

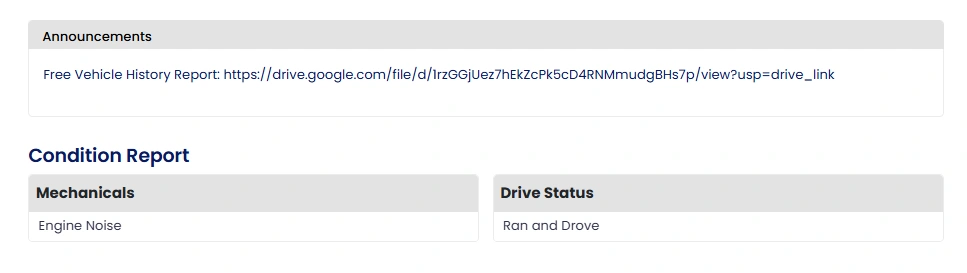

Why Auctions Are a Smart Choice for Car Purchases

Auctions can be an excellent source for late-model vehicles with clear chains of title and affordable pricing. Twin Cities Auctions, based in Minnesota, is one such reputable auction house that offers a wide range of vehicles at competitive prices.

Key Benefits of Buying from Auctions:

- Wide Selection: Auctions like Twin Cities Auctions offer a variety of vehicles, from low-budget cars to high-end models.

- Competitive Pricing: Auctions often offer vehicles at prices below retail value, enabling dealers to maximize their profit margins.

- Transparency: Auctions provide full vehicle history reports, so you know exactly what you’re buying.

- Convenient Bidding: Many auctions offer online bidding for your convenience, making it easier to source vehicles without being physically present.

Twin Cities Auctions: A Smart Vehicle Sourcing Choice

For those in the automotive industry, Twin Cities Auctions offers an excellent platform for sourcing quality vehicles at competitive prices.

Whether you are just starting or expanding your business, this auction house provides transparency, competitive pricing, and a broad selection.

| Feature | Description |

| Inventory Variety | Wide range of cars, trucks, and SUVs available |

| Competitive Pricing | Below-market pricing allows for higher profit margins |

| Vehicle History Reports | Detailed history reports for every vehicle |

| Online Bidding | Convenient online bidding options for dealers |

| Financing Options | Financing available to help with inventory purchases |

Conclusion

Profitably exporting to Panama hinges on precise cost modeling, strict compliance with 15 % duty and 7 % VAT, and streamlined logistics.

Sourcing via reliable U.S. auctions like Twin Cities Auctions ensures clean titles and condition transparency—the foundations of a successful export operation.

Find Your Next Ride Online at Twin Cities Auctions—No Dealer License Required

Searching for your next vehicle? Twin Cities Auctions offers an online, transparent car auction experience that’s accessible to everyone, no dealer license needed. Browse and bid on a diverse selection of quality vehicles from the comfort of your home.

Whether you’re a first-time buyer or an experienced trader, our clear, honest bidding process ensures you can make informed decisions in a supportive environment. Join our next online auction and discover how effortless and enjoyable finding your next car can be with Twin Cities Auctions!

Looking for more options? Explore our comprehensive list of all available car auctions across the United States. Your next deal might be just a click away!

FAQ

What are Panama’s auto import duties?

Customs duty 15 % of CIF; VAT 7 % on CIF + Duty.

Can I export used cars to Panama?

Yes; both new and used imports follow the same procedure and levies.

How long does clearance take?

Typically 3–5 business days once docs are in order.

Are vehicle safety inspections mandatory?

Yes; AMPATEL‑certified Safety Inspection Report is required.

How do I handle documentation issues?

Work with a customs broker to resolve errors promptly; budget for demurrage.

Source Links

https://oec.world/en/profile/country/usa/reporter/pan/product/cars

https://www.export.gov/knowledge-product/panama-import-requirements-and-documentation