In 2023, Cambodia imported $324 million of passenger cars (HS 8703), up 12 % from 2022, driven by rising incomes and urban expansion in Phnom Penh and Sihanoukville.

The average CIF price reached $8 750 per unit due to strong demand for late-model Japanese sedans and SUVs. For U.S. exporters, this growth translates into premium margins—if you can navigate Cambodia’s layered duties, technical requirements, and port logistics effectively.

Key Takeaways

- Market Growth: 2023 imports hit $324 M, a 12 % increase over 2022

- Unit Economics: Average CIF price of $8 750 per vehicle

- Documentation: Commercial Invoice, Customs Declaration, Bill of Lading, Certificate of Conformity, Roadworthiness Certificate

- Levies: 35 % Import Duty, 10 % VAT, and up to 40 % Additional Registration Tax (ART)

- Gateways: Sihanoukville Port and Phnom Penh Inland Depot

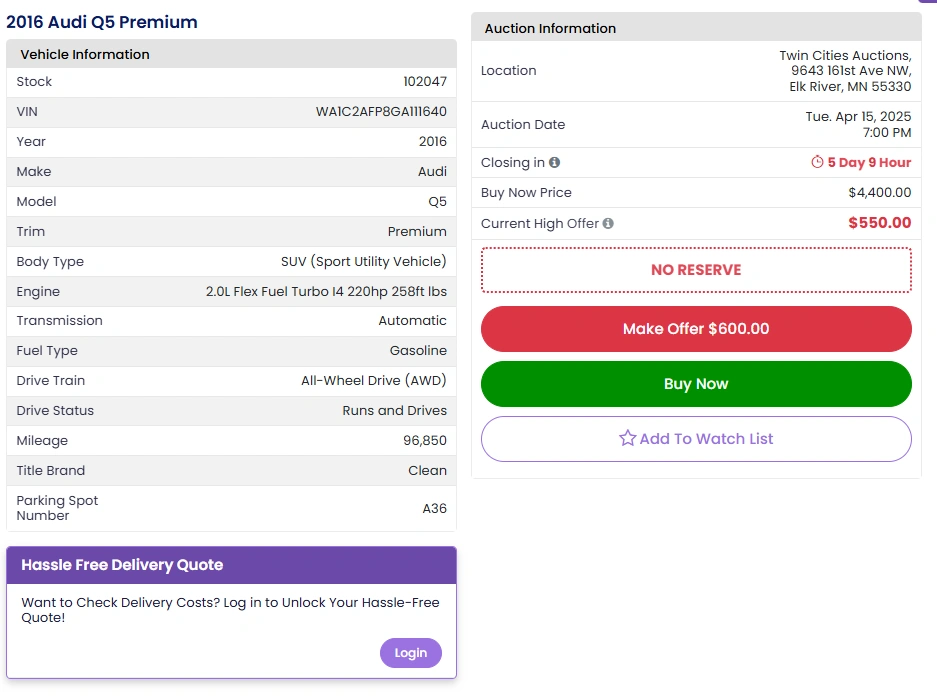

- Sourcing: U.S. auctions like Twin Cities Auctions for transparent grading and clean titles

Understanding the Cambodian Market

Cambodia’s vehicle market is thriving thanks to a fast-growing middle class and expanding road infrastructure across urban and rural areas.

As incomes rise, more consumers are upgrading from motorcycles to compact cars and family-sized SUVs. In Phnom Penh, worsening traffic congestion has also pushed demand for vehicles with better fuel efficiency and comfort.

Additionally, government-led modernization efforts, such as infrastructure upgrades and green vehicle incentives, are shaping consumer preferences and purchase timing.

Rapid GDP growth (over 6 % annually) and urbanization have fueled vehicle demand. Phnom Penh’s population density (over 2 million) drives daily commute needs, while rising tourism spurs luxury and SUV imports.

Government incentives for newer, safer models mean late-model vehicles command substantial premiums.

| Year | Import Value (USD M) | YoY Change |

| 2022 | 290 | — |

| 2023 | 324 | +12 % |

| Metric | 2023 Figure |

| Avg. CIF Price per Vehicle | $8 750 |

Consumer Preferences

Cambodian buyers often seek practical, durable vehicles that balance affordability and ease of maintenance, which explains the dominance of Japanese brands. Hybrid and fuel-efficient models are gaining traction as fuel costs rise and environmental awareness grows.

Meanwhile, a younger, urban buyer segment is beginning to show interest in sportier designs and premium interiors, even within lower price ranges. European luxury vehicles, while niche, are viewed as status symbols among the wealthy elite and business owners.

- Japanese Brands Dominate: Toyota, Honda, Nissan represent over 75 % of imports by volume.

- SUV and Crossover Surge: Demand for higher-seated vehicles up 18 % since 2021.

- Luxury Niche: Limited but growing appetite for European makes (BMW, Mercedes).

Regulations & Compliance

Cambodia uses the ASEAN Harmonized Tariff Nomenclature (AHTN) aligned with HS 8703. The General Department of Customs and Excise (GDCE) enforces:

| Document | Purpose |

| Commercial Invoice | Declares sale price and trading parties |

| Customs Declaration | Official import entry and duty assessment |

| Bill of Lading | Proof of ocean/air shipment |

| Certificate of Conformity | Verifies technical compliance with GDCE standards |

| Roadworthiness Certificate | Ensures vehicle meets safety and emission checks |

Source: GDCE Import Procedures

Technical Standards

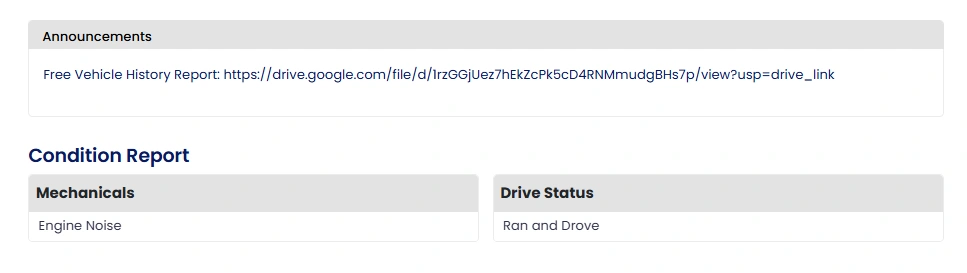

Cambodia’s technical vehicle standards are becoming more aligned with international norms as the country looks to improve road safety. Vehicles without functioning airbags or ABS are increasingly scrutinized and may be denied entry.

It’s also crucial that headlights, speedometers, and emissions control systems meet local specs, which often requires minor modifications for U.S. or Japanese imports. Importers should budget for inspection-ready modifications when sourcing stock.

- Emission Limits: Euro 4 or better mandatory for all imports.

- Safety Requirements: Working airbags, ABS brakes, and structural integrity checks.

- Inspection Regime: GDCE–approved workshops conduct pre-shipment roadworthy tests; certificates must accompany each shipment.

Tariffs & Taxes

Cambodia’s tax structure is heavily front-loaded, meaning duties and taxes are collected before release—not at the point of sale. This can create significant cash flow strain for small exporters or local dealers who must pre-finance the total cost.

Because ART (Additional Registration Tax) is tiered by engine size, even a slight bump in displacement can mean a sharp increase in cost. Importers must be precise in sourcing vehicles that fall into optimal ART bands to protect margins.

Cambodia’s multi-layered levy structure requires precision:

| Levy | Rate | Base |

| Import Duty | 35 % | CIF |

| Value-Added Tax (VAT) | 10 % | CIF + Import Duty |

| Additional Registration Tax | 20–40 % | CIF + Import Duty + VAT |

Source: Ministry of Economy & Finance tariff schedule

ART Bands

- Small Cars (≤ 1.5 L): 20 % ART

- Mid-Size (1.6–2.5 L): 30 % ART

- Large (> 2.5 L or luxury): 40 % ART

Crafting Your Landed-Cost Model

An accurate spreadsheet dissects each component:

| Component | Calculation |

| CIF Cost | FOB Price + Freight & Insurance |

| Import Duty (35 %) | 0.35 × CIF |

| VAT (10 %) | 0.10 × (CIF + Import Duty) |

| ART (avg 30 %) | 0.30 × (CIF + Import Duty + VAT) |

Aim for a 10–15 % margin above landed cost to cover brokerage, demurrage, and FX volatility.

Main Gateways

Sihanoukville Port, while modernized, often faces congestion and seasonal backlogs, especially during holidays and regional import spikes.

While Phnom Penh Inland Depot offers smoother processing, it may require added rail or road freight that impacts delivery times.

Importers should weigh trade-offs between cost and speed when choosing entry points. Additionally, working with bonded warehouses near these gateways can reduce customs pressure and offer flexibility in last-mile delivery.

- Sihanoukville Autonomous Port – Cambodia’s principal deep-sea terminal; handles 90 % of vehicle imports.

- Phnom Penh Inland Depot – Inland container yard offering direct rail and road links to the capital for just-in-time distribution.

Common Pitfalls to Avoid

Many first-time exporters to Cambodia underestimate the strict enforcement of vehicle compliance and over-rely on third-party agents for due diligence. Errors in documentation—like mismatched chassis numbers or untranslated invoices—can result in costly delays or shipment rejection.

Overloading containers to save on freight costs can also raise red flags with customs, especially for higher-taxed vehicle types.

Building relationships with local fixers or brokers can often make the difference between smooth clearance and costly re-export.

| Common Pitfall | Details |

|---|---|

| Underestimating ART Rates | Always verify engine-size bands per GDCE guidelines to avoid unexpected tax increases. |

| Skipping Emission & Safety Checks | Non-compliant units may be fined or required to be re-exported, delaying sales and adding cost. |

| Incomplete Documentation | Mismatches between the invoice, Certificate of Conformity, and roadworthy certificate lead to customs holds. |

| Ignoring Currency Fluctuations | KHR volatility can erode profit margins—consider hedging via forward contracts for stability. |

Why Auctions Are a Smart Choice for Car Purchases

Auctions can be an excellent source for late-model vehicles with clear chains of title and affordable pricing. Twin Cities Auctions, based in Minnesota, is one such reputable auction house that offers a wide range of vehicles at competitive prices.

Key Benefits of Buying from Auctions:

- Wide Selection: Auctions like Twin Cities Auctions offer a variety of vehicles, from low-budget cars to high-end models.

- Competitive Pricing: Auctions often offer vehicles at prices below retail value, enabling dealers to maximize their profit margins.

- Transparency: Auctions provide full vehicle history reports, so you know exactly what you’re buying.

- Convenient Bidding: Many auctions offer online bidding for your convenience, making it easier to source vehicles without being physically present.

Twin Cities Auctions: A Smart Vehicle Sourcing Choice

For those in the automotive industry, Twin Cities Auctions offers an excellent platform for sourcing quality vehicles at competitive prices.

Whether you are just starting or expanding your business, this auction house provides transparency, competitive pricing, and a broad selection.

| Feature | Description |

| Inventory Variety | Wide range of cars, trucks, and SUVs available |

| Competitive Pricing | Below-market pricing allows for higher profit margins |

| Vehicle History Reports | Detailed history reports for every vehicle |

| Online Bidding | Convenient online bidding options for dealers |

| Financing Options | Financing available to help with inventory purchases |

Conclusion

Exporting cars to Cambodia demands rigorous cost modeling, strict compliance with GDCE’s technical and tariff requirements, and optimized use of Sihanoukville and Phnom Penh gateways.

Leveraging transparent auctions—such as Twin Cities Auctions—provides reliable supply, clean titles, and detailed condition data, enabling repeatable profit in this booming Southeast Asian market.

Your Next Car is Just a Click Away at Twin Cities Auctions!

Twin Cities Auctions brings the excitement of car auctions directly to your screen. No dealer license? No problem! Our online platform is open to the public, offering a wide range of vehicles to suit all tastes and budgets.

Whether you are an automotive enthusiast or a first-time buyer, you’ll find an impressive variety of vehicles that cater to all tastes and budgets. From reliable family sedans and eco-friendly hybrids to high-performance cars and premium SUVs, our listings are curated to ensure quality and diversity.

Enjoy a hassle-free bidding process and secure your perfect match from our extensive lineup. Don’t miss out—your next car is just a click away at Twin Cities Auctions!

Looking for more options? Explore our comprehensive list of all available car auctions across the United States. Your next deal might be just a click away!

FAQ

What are Cambodia’s auto import duties?

Import Duty 35 %, VAT 10 %, ART 20–40 % on CIF.

Can I export used cars to Cambodia?

Yes; vehicles must meet Euro 4+ emissions and be ≤ 10 years old at import.

How long does clearance take?

Customs release typically within 3–5 business days post-document submission.

Are there vehicle age restrictions?

Imports over 10 years old require special approval and additional inspection.

How do I handle a customs hold?

Engage a GDCE-approved clearing agent to resolve technical or documentation issues promptly.

Source Links

https://comtrade.un.org/data/2023/HS8703/KHM/all

https://www.indexbox.io/search/passenger-car-price-cambodia/ https://gdce.gov.kh/import-procedures